Contents

Reporting

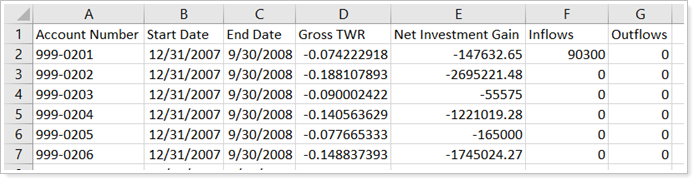

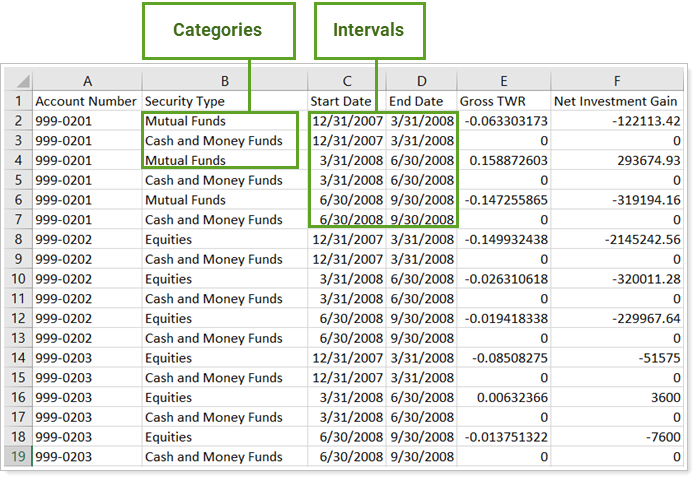

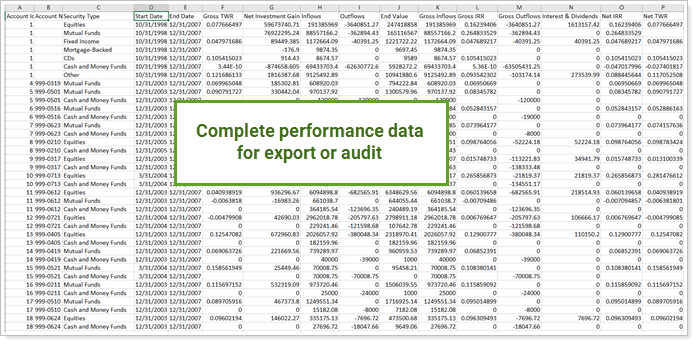

New Report to Extract Detailed Category and Interval Performance Data

Dynamic performance reports on Tamarac's Reporting platform offer insights into key aspects of performance. But broad, firmwide performance data has historically been more difficult to come by.

If you've ever wanted to evaluate performance of an asset class across accounts or groups, see the performance of unrelated accounts over certain intervals, or audit batches of uploaded performance data, the new Performance Data Extract bulk report is for you.

This new bulk report gives you access to performance data combined with advanced interval, grouping, and filtering capabilities. With the Performance Data Extract bulk report, you can:

-

Audit returns across accounts. Access a deeper, broader cross-section of performance data including more accounts, groups, or account sets than ever before. Answer questions like "What managed accounts had the largest returns over the last year?"

-

Evaluate returns by category, interval, or both. Filter all the accounts in the bulk report by category type; check returns over monthly, quarterly, or annual intervals; or combine both to evaluate category returns over the desired interval. Answer questions like "What accounts had the highest returns for equities each quarter over the last 5 years?" and "What categories performed worst per month over the last year?"

-

Check Manually Uploaded Returns. If you upload your interval performance data to Tamarac, use this report to check and, if needed, fix errors.

-

Integrate with third parties. Export performance data for use in third party platforms not yet supported directly in Tamarac.

To learn more about features and use this report, see Performance Data Extract Bulk Report.

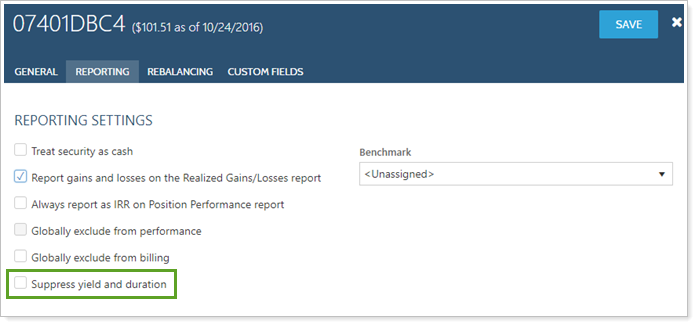

Suppress Yield and Duration Reporting for Debt Securities

We've made our debt securities reporting a little more flexible. Now, if your firm prefers, you can choose to suppress the yield and duration from reporting for fixed income, mortgage-backed, CD, T-bill, and commercial paper security types.

With this release, you can control yield and duration reporting:

-

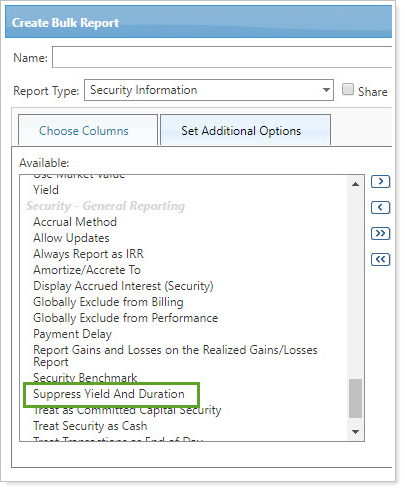

For an Individual Security. To suppress yield and duration for an individual security, on that security's Reporting Settings panel, select Suppress yield and duration. Yield will be suppressed for that individual security only.

-

For several Securities at Once. Use multi-edit to select and edit the Suppress yield and duration configuration for several existing individual securities at one time, or export and edit with the Suppress yield and duration column in bulk reports and bulk data uploads.

-

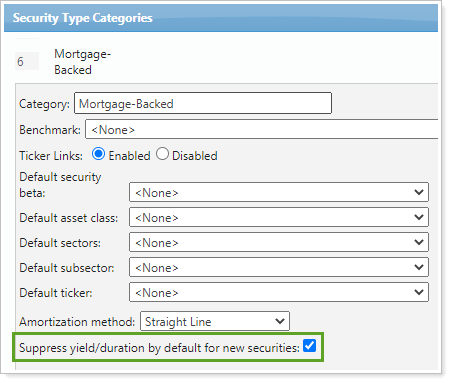

For all New Securities in a Category. To suppress the yield and duration calculation for all new securities of a specific category type, select Suppress yield/duration by default for new securities when you edit the category type. Choosing this option doesn't change the yield and duration calculation behavior for existing securities of that type, but Tamarac will suppress yield and duration reporting for future securities added to this category type.

For more information on editing securities and categories, see Suppress Yield and Duration Reporting for Debt Securities.

Include Payment Delay for Mortgage-Backed Securities

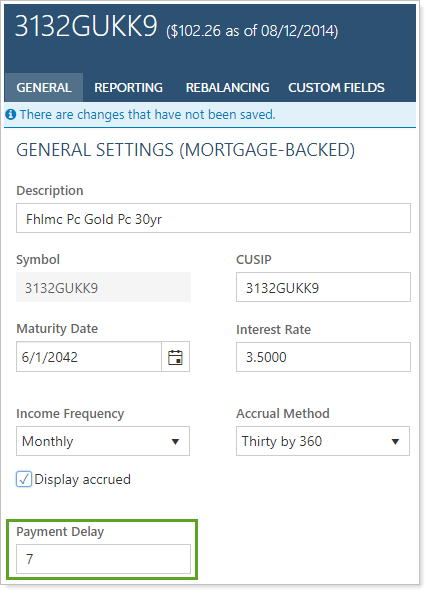

Mortgage-backed securities can play an important role in clients' portfolios. But different mortgage-backed securities pass through principal and interest payments to clients on different timeframes. These payment delays can have real consequences for the accrued income calculation, which can impact asset valuation and performance reporting.

To improve the accuracy of these calculations, you can now enter the number of days each mortgage-backed security delays payments in Payment Delay on the General Settings panel. Edit existing securities in bulk with the Payment Delay column in bulk reports and bulk data uploads.

Depending on the data feed, Tamarac may receive payment delay data for some new mortgage-backed securities after this release.

Once entered, Tamarac Reporting will use this value in the accrued income calculations for that security.

For more information on editing securities and categories, see Add Payment Delay for Mortgage-Backed Securities.

Client Portal Assets & Liabilities Page Includes Views, a Net Worth Summary, and More

Last release, we introduced you and your clients to the enhanced Assets & Liabilities client portal page. With this release, we add a few exciting new features:

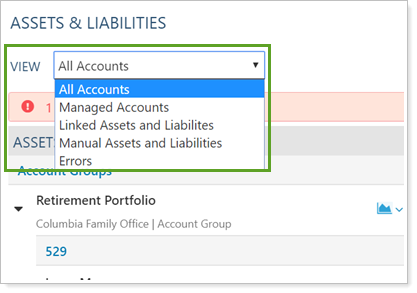

Change Views

Clients can use the new View list to filter the Assets & Liabilities page to display only specific accounts. For example, a client interested in accounts under your management could choose the Managed Accounts view, while a client interested in his held-away assets and liabilities might choose the Linked Assets and Liabilities view.

Clients with an Assets & Liabilities page included in their client portal automatically see theView list after the release.

You cannot add, edit, or remove views. However, if you choose not to show managed accounts on the Assets & Liabilities page, your clients won't see the Managed Accounts list option.

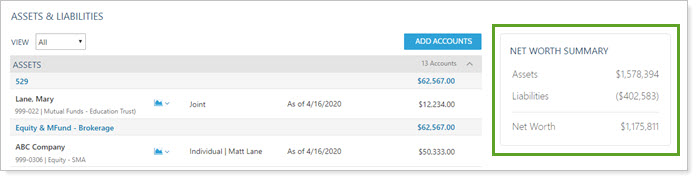

See a Net Worth Summary

If the Assets & Liabilities page brings together disparate elements of a client's finances into one picture, the new Net Worth Summary section provides a quick, at-a-glance overview of that picture.

This new section appears on the Assets & Liabilities page. It is not configurable.

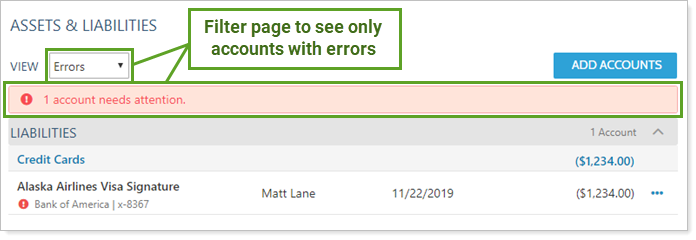

Find Errors More Easily

One of the exciting innovations we introduced with the Assets & Liabilities page last release was the ability for clients to more easily identify and resolve linked account errors themselves. We know, however, that some clients have many accounts, requiring scrolling to find accounts with errors.

With this release, we provide clients with two new ways to quickly find accounts that need attention:

-

View list

-

Clickable alert bar

Clients can use either option to filter the Assets & Liabilities page to display only linked accounts with errors that the client can resolve.

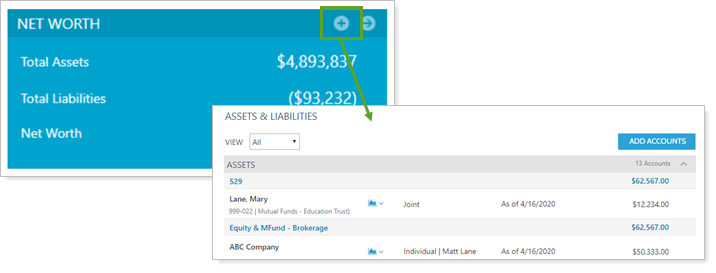

Link Net Worth Dashboard Tiles to Assets and Liabilities Page

Give clients quick access to the Assets & Liabilities page from the dashboard when they click + from any Net Worth dashboard tile.

To add an Assets & Liabilities page link to a Net Worth dashboard tile, select the Include link to Assets & Liabilities page check box when you configure the dashboard. For more information, see Link from a Net Worth Dashboard Tile to the Assets and Liabilities Page.

For more information about the Assets & Liabilities client portal page, see Client Views - Assets and Liabilities Page and Use the Client Portal Assets & Liabilities Page.

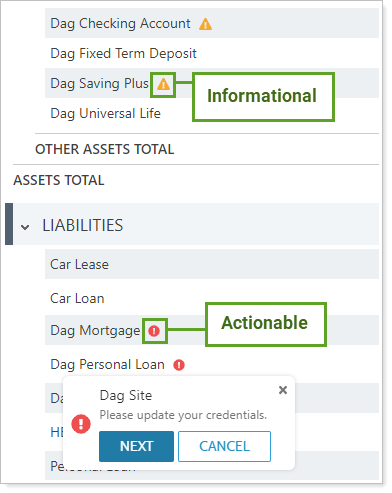

New Error Alerts and Resolution on the Net Worth Report

As we've expanded our offerings around reporting on held-away assets and liabilities, the Net Worth report's usefulness has expanded as well. With clients likely spending more time looking at the report, naturally they'll notice when there's an issue with linked account credentials. Now you and your clients can resolve actionable linking errors (marked with  ) on the Net Worth report while being alerted to linked account issues that only you, the advisor, can fix (marked with

) on the Net Worth report while being alerted to linked account issues that only you, the advisor, can fix (marked with  ).

).

Linked error alerts and resolution functionality works the same as it does on the Assets & Liabilities client portal page.

For more information about the Net Worth report, see Net Worth Report.

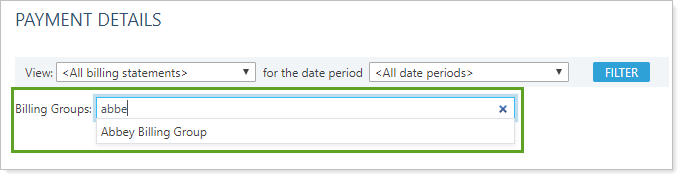

Find Billing Groups More Easily on the Payment Details Page

Many firms create numerous billing groups, and finding individual billing groups can be difficult on pages like Payment Details, where you used to choose from a potentially long list of billing groups. We've enhanced the user experience by changing the billing groups list on Payment Details to an auto-completing search to help you find billing groups more quickly.

To search for a billing group, begin typing and click the name of the billing group when it appears. You must type at least two letters to see any groups listed.

For more information on using the Payment Details page, see Billing Reconciliation.

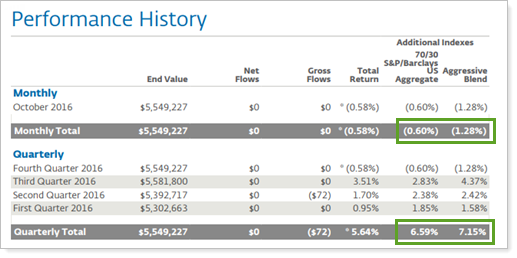

See Benchmarks and Indexes Subtotaled on the Performance History Report

You may recall that recently we enhanced subtotaling on the Performance History report. With this release, we expanded subtotaling on the Performance History report. Now all data points, including benchmarks and indexes, display subtotals.

Mobile App Brought Up to Date

The mobile app gives your clients 24/7 access to their data. To ensure continuity of access, we've updated the mobile app code so it works smoothly with the latest versions of iOS and Android.

Integrations

Share MoneyGuide Financial Report PDFs Through the Tamarac Document Vault

Sharing financial files requires stringent digital file security. Now you and your clients can save time, reduce number of logins, and feel confident in file security by accessing MoneyGuide financial plan report PDF files in Tamarac's document vault.

If your firm uses the MoneyGuide integration, when you click Create & Save to History in MoneyGuide, copies of the MoneyGuide financial plan report automatically save to the Tamarac document vault. You and your clients see those PDF reports saved in the Financial Plans folder.

For clients to see MoneyGuide financial plan PDF reports, they must be linked with the MoneyGuide integration and marked as Primary or Secondary. When you save the file, the client will see a document vault notification badge next time they log in to their portal. Clients do not receive an email notification when a new MoneyGuide file is saved into their document vault.

You'll notice a new Financial Plans folder in document vaults for advisors and clients. This automatically generated folder cannot be deleted because Tamarac saves all MoneyGuide reports into that folder, but you can rename and reorder the folder.

For more information, see See MoneyGuide Financial Plan Reports in the Document Vault.

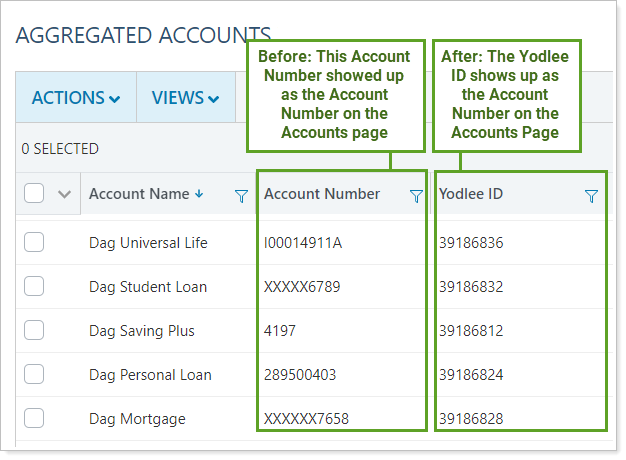

Reconciled Accounts Use Yodlee ID as Account Number

We’ve heard your feedback about how account numbers for Yodlee integrated reconciled accounts do not always work smoothly with rebalancing features. In response to your feedback, we replaced the previous account numbers with the account's Yodlee ID numbers for new and existing reconciled accounts.

To identify current accounts on the Accounts page that change:

-

Run an Account Information bulk report.

-

Include the Yodlee ID column.

-

When you generate the report, you’ll see a list of all accounts with the Yodlee ID noted. Any account in the report with the Yodlee ID column populated uses that Yodlee ID as an account number.

You’ll still see the institutional account number on the Aggregated Accounts page. To export those values, use Export Data in the Actions list.

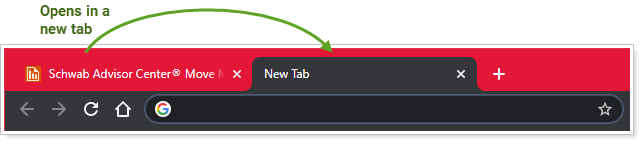

More Secure Access to Schwab Move Money

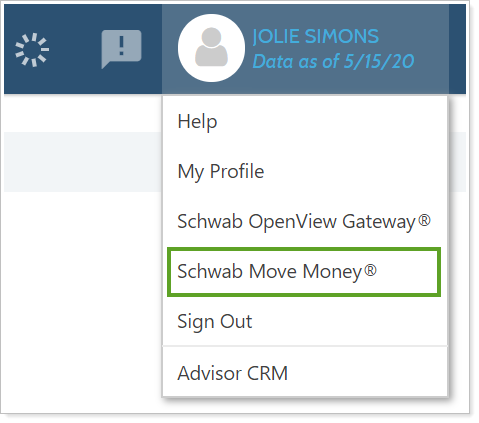

Both Tamarac and Schwab are concerned about your online security. To support increased security measures, we've updated the way you can access Schwab Move Money from within Tamarac. Now, when you access Schwab Move Money, you'll see a notification that lets you know you're leaving Tamarac to securely sign into Schwab Move Money, which opens in a new tab.

You'll now access Schwab Move Money in the profile menu, just as you would for many other custodial integrations available within Tamarac.

This change enhances security and allows you to access Schwab Move Money the same way you access other custodian integrations.

Performance Enhancements

As part of our ongoing effort to improve speed and reliability on the Tamarac Platform, we are continuing to make enhancements under the hood. The table highlights improvements we've made between our last release and this release:

| Improvement Made | Type of Improvement |

|---|---|

| We've changed how our engine accesses indexes and benchmarks. Now indexes calculate 10x faster on average, Allocation Weighted Benchmark returns calculate up to 50x faster, and index-related system slowness has been dramatically decreased across the platform. | Database/Code |

|

On average, reduced sync times by 22% and made data available to firms 15 minutes earlier in the day from Q1 to Q2. These faster, more consistent daily syncs and earlier data delivery stem from:

|

Database/Code |

|

We increased overall platform performance with storage upgrades for higher Input/Output and availability. |

IT/Infrastructure |

|

We eliminated bottlenecks that caused site slowness and ensured more consistent uptime by doubling our processor capacity. |

IT/Infrastructure |

|

We improved performance for two saved search filters to reduce search times by between 80% and 90%. |

Database/Code |

|

Beginning with the June release and over the course of the next few months, we’re adjusting the daily sync of individual firms so Trading and Reporting data sync in parallel. This will shorten the full sync duration for some firms who use both Tamarac Trading and Reporting. This could mean some firms might be able to start trading sooner in the morning. |

Database/Code |

Learn More - Watch the Release Video