Contents

Introduction

With billing reconciliation, you can manually and automatically reconcile payments for your services, which helps you account for every billing statement and payment in your firm.

You can mark payments as unpaid, paid, and partially paid and run reconciliation reports to track your outstanding fees.

Auto-Reconciliation

Advisor View can automatically reconcile payments for billing statements. When you perform auto-reconciliation, Advisor View looks through your management expense transactions for a matching dollar amount within the time period you specify.

For example, let's say you need to reconcile a payment of $40.45 in account 1234-5678 90 days after the billing date. Advisor View searches for management expense transactions of $40.45 in account 1234-5678 90 days after the billing date. When a matching transaction is found, Advisor View marks the billing statement as paid.

To perform auto-reconciliation:

-

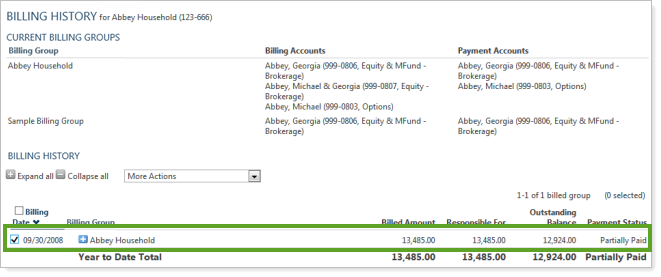

On the Billing menu, click Billing History.

-

Select the check boxes next to the billing statements that you want Advisor View to automatically reconcile as paid.

-

In the More Actions list, click Auto-Reconcile.

-

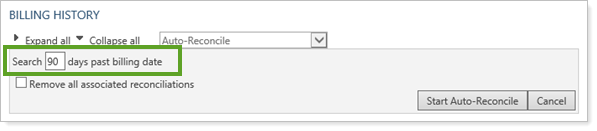

In the Search box, choose the number of days past the billing date that you want Advisor View to search for management expense transactions that match the billing statement amount. The default number of days is 90.

-

Select the Remove all associated reconciliations check box, if applicable.

If you select this check box, all reconciliation data will be deleted and removed from the selected statements, including reconciliation data generated automatically or manually. Selecting this check box will also remove reconciliation details from the Auto-Reconciliation History page and mark the Payment Status of any associated reconciliation histories as deleted. This feature will allow you to remove reconciliation data associated with transactions that have been removed from Advisor View.

If the billing group was previously auto-reconciled for the selected billing date, Advisor View will add a note on the Auto-Reconciliation History to let you know that the auto-reconciliation was overwritten.

When you do not select this check box, billing statements that have been fully or partially manually reconciled or auto-reconciled will be ignored.

In most cases, it's best to clear this check box unless you want to "start over" reconciling the selected billing statements.

-

Click Start Auto-Reconcile. When the auto-reconciliation is complete, Advisor View will take you to the Auto-Reconciliation History page where you can see the results of the auto-reconciliation. For more information on the Auto-Reconciliation History report, visit Run an Auto-Reconciliation History Report.

Auto-Reconciliation History

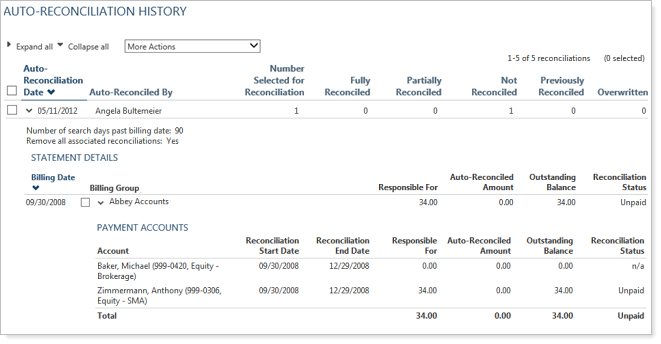

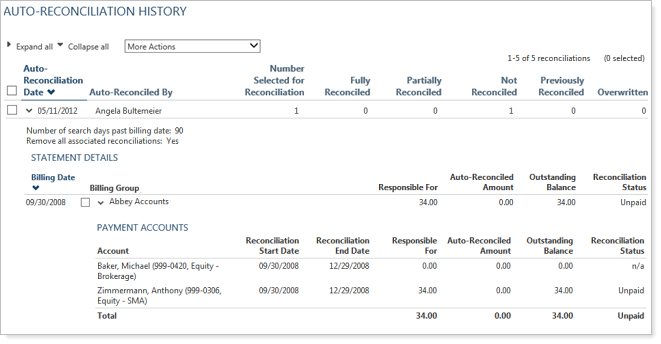

After you run auto-reconciliation, view the Auto-Reconciliation History report and review any reconciliation errors that need to be corrected. This report is generated automatically after you run auto-reconciliation or you can run it whenever needed. To run the report manually, on the Billing menu, click Auto-Reconciliation History.

The Auto-Reconciliation History report shows the number of accounts that you selected for auto-reconciliation and the number of accounts that were fully, partially and previously reconciled.

The following columns appear on the report:

| Field | More Information |

|---|---|

| Number Selected for Reconciliation | The number of statements Advisor View attempted to auto-reconcile. |

| Fully Reconciled |

The number of billing statements where payment amounts were found and associated automatically to fully fulfill the amount all payment accounts were responsible for. |

| Partially Reconciled | The number of billing statements where a matching payment amount was found for at least one payment account in a billing group but not all payment accounts in all billing groups. |

| Not Reconciled | The number of billing statements where no matching management fee could be found for any payment account in any billing group. |

| Previously Reconciled | The number of statements skipped because the statement was previously reconciled. |

| Overwritten | The number of statements originally selected for auto-reconciliation that are no longer available because the associated billing history or the historical auto-reconciliation entry was deleted after the auto-reconciliation was run. |

| Responsible For | The amount the billing group is responsible for paying. |

| Auto-Reconciled Amount |

The amount automatically reconciled. N/A will appear in this field if this account is not included in the current auto-reconciliation—for example, if the account was reconciled in a previous attempt. |

| Outstanding Balance | This is the amount that has not yet been paid for the selected account or billing group. For accounts with a reconciliation status of Paid, $0.00 will appear in this field. |

| Reconciliation Status | The status of the auto-reconciliation. |

| Reconciliation Start Date | The first date that the auto-reconciliation searched for matching management expense transactions. |

| Reconciliation End Date | The last date that the auto-reconciliation searched for matching management expense transactions. The number of days to look for matching management expense transactions is specified when initiating the auto-reconciliation on the Billing History page. For more information, visit Billing History Report. |

If you want to delete the auto-reconciliation history, select the check box next to the item you want to delete, and then click Delete in the More Actions list.

To export the auto-reconciliation history, select the check box next to one or more items you want to export, and then click Export Data in the More Actions list.

To find the payment details for a particular billing group, click View Payment Details.

Payment Details

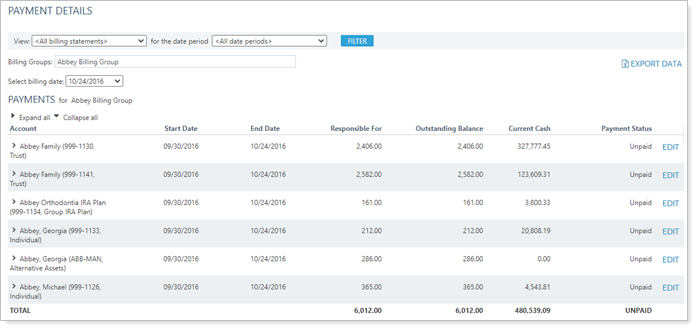

To find out information on a particular payment or billing group, visit the Payment Details page. This page lists the applied payments, reconciliation notes, payment status, and more for each billing statement.

You can also manually reconcile a billing statement on this page or export the payment details to Microsoft Excel®.

To view the payment details:

-

On the Billing menu, click Payment Details.

-

In the View list, choose one of the following:

All billing statements

Paid

Partially Paid

Unpaid

Partially Paid or Unpaid

-

Select the date period you want to filter by.

-

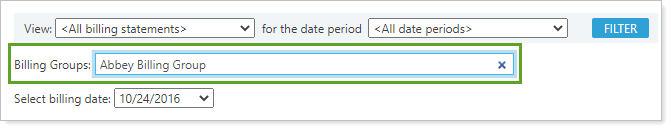

In Billing Groups, type at least two letters of the billing group name. Click the appropriate billing group when it appears.

-

Do one of the following:

Export the Payment Details. To export a payment, click Export Data at the top of the page.

Manually Reconcile a Billing Statement. For more information on manually reconciling a billing statement, visit Manually Reconcile a Billing Statement.

Manually Reconcile a Billing Statement

In some cases, you may need to manually reconcile a billing statement—for example, if the client pays with a check or if the client only pays part of a bill.

To manually mark a billing statement as paid, partially paid, or unpaid, follow these steps:

-

On the Billing menu, click Payment Details.

-

In View, choose one of the following:

-

All billing statements

-

Paid

-

Partially Paid

-

Unpaid

-

Partially Paid or Unpaid

-

-

In date period, choose the date period you want to manually reconcile. All your firm's date periods are available.

-

In Billing Groups, type at least two letters of the billing group name. Click the appropriate billing group when it appears.

-

In Select a billing date, choose the applicable billing date.

-

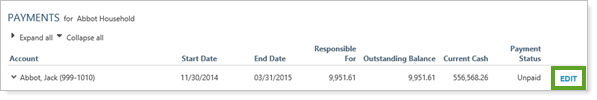

Click Edit next to the billing statement you want to edit.

-

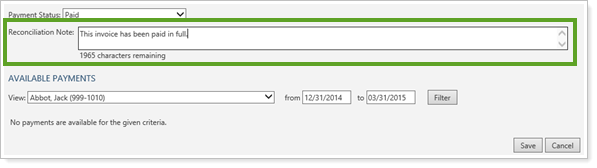

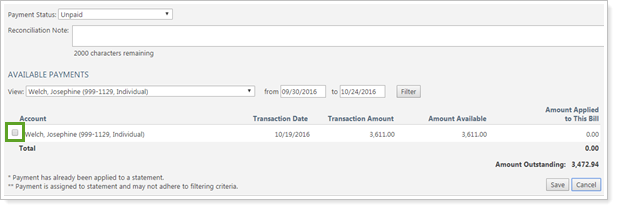

In Payment status, choose the payment status of the billing statement. You can mark it as paid, unpaid, or partially paid.

-

In Reconciliation note, type a note for the reconciliation. This note appears on the Auto-Reconciliation page and helps you identify billing groups that have been manually reconciled, and what was done during that reconciliation.

-

If you want to manually search for a payment, follow these steps:

-

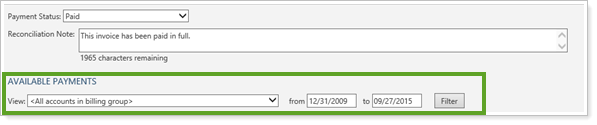

Under Available Payments, in the View list, choose the account that made the payment. If you want to search for all accounts, click All accounts in billing group.

-

In the From and To boxes, specify the date range that you want Advisor View to search for management expense transactions. This searches for all the transactions in the selected account that are marked as management expenses, and therefore could be applied to an outstanding bill.

-

Click Filter. A list of transactions in that account within that date range appears.

-

Select a check box next to one or more transactions that you want to apply to the bill. Click Save.

-

-

Click Save.