Contents

Reporting

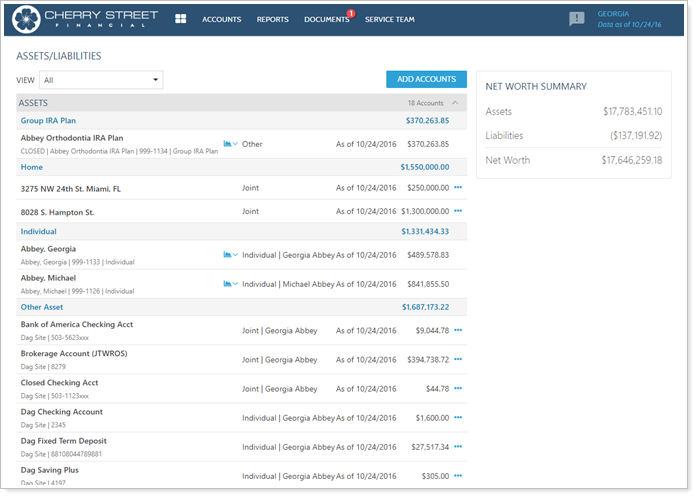

New Assets and Liabilities Page for Clients

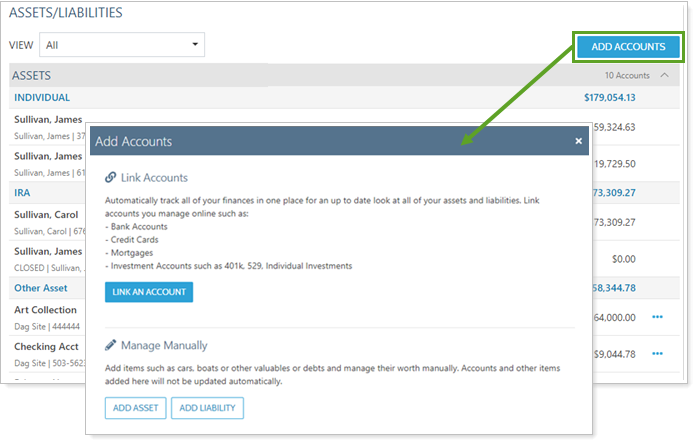

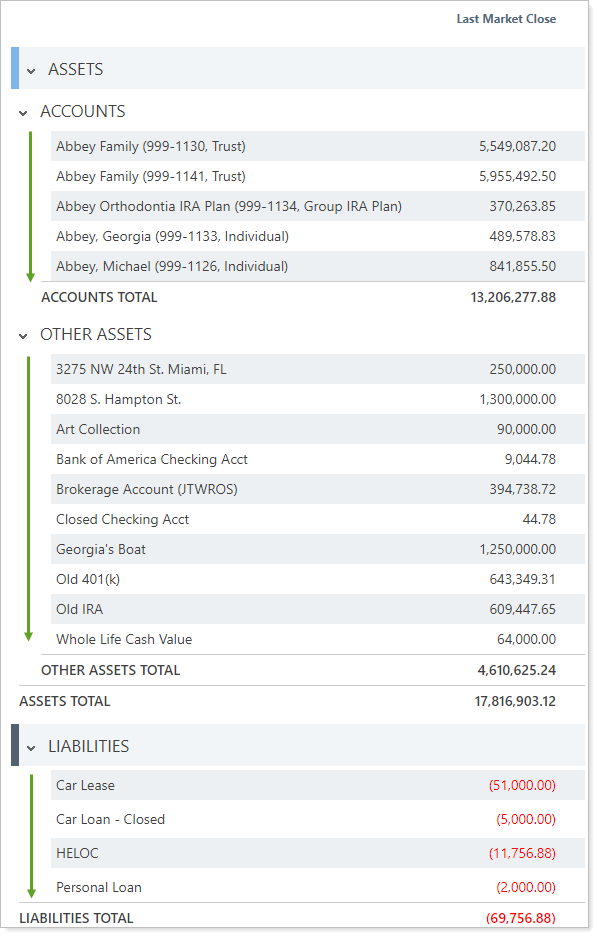

This release, enhance your clients' portal experience with the new Assets & Liabilities page for the desktop client portal. This page, which acts like an Aggregated Accounts page for your clients, brings the many pieces of clients' financial lives together in one place.

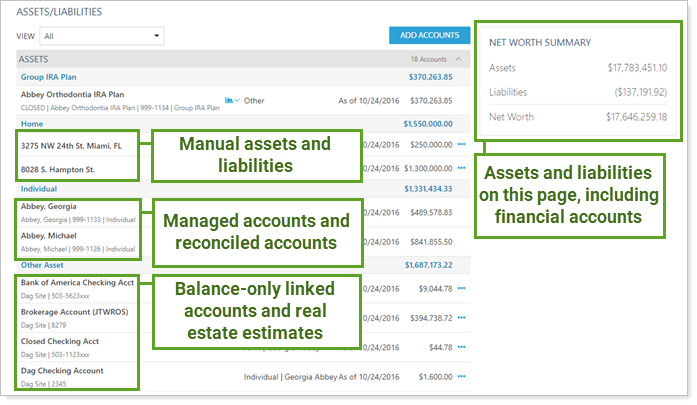

The Whole Financial Puzzle, Together At Last

Show clients their financial accounts and closed accounts alongside manually entered assets and liabilities, balance-only linked accounts, and reconciled linked accounts. Account value, owner, and as of date fill in details of the picture.

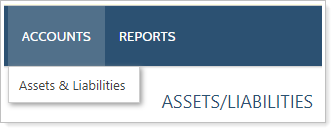

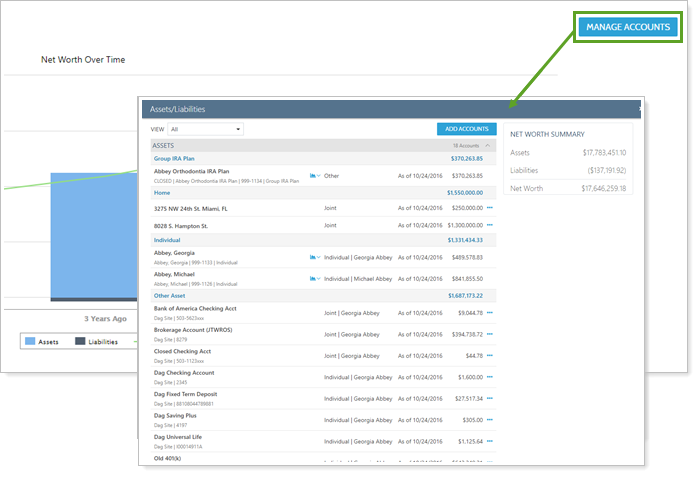

Two Logical Places to access the new Assets & Liabilities Page

Clients readily access the Assets & Liabilities page in the client portal from:

-

The Accounts menu.

-

The Net Worth report, using the new Manage Accounts button.

Tools at Clients' Fingertips

We recommend having clients use the Assets & Liabilities page to maintain records of external financial accounts in Tamarac. This keeps passwords secure, avoids any questions of custody, and lets clients update details of their assets and liabilities that they know best.

On this page, clients can:

-

Add, edit, or delete new balance-only linked accounts or manual assets and liabilities.

-

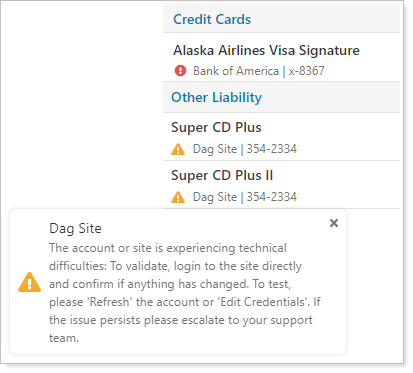

Resolve actionable linking errors (marked with

) while being alerted to linked account issues that only you, the advisor, can fix (marked with

) while being alerted to linked account issues that only you, the advisor, can fix (marked with  ).

).

-

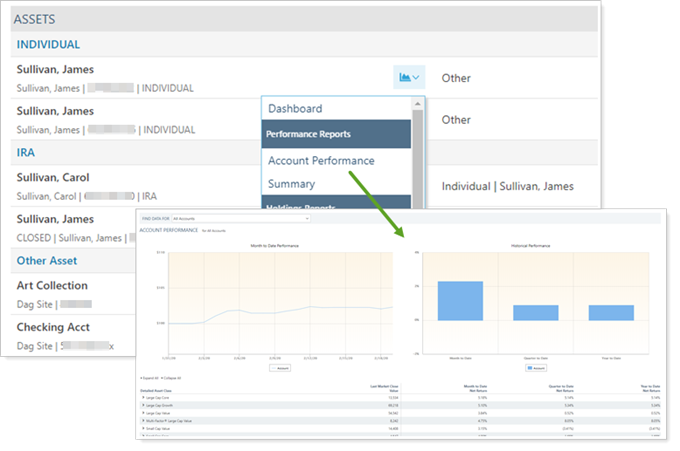

Jump to the client portal dashboard page or any of the reports you've set up for that client view.

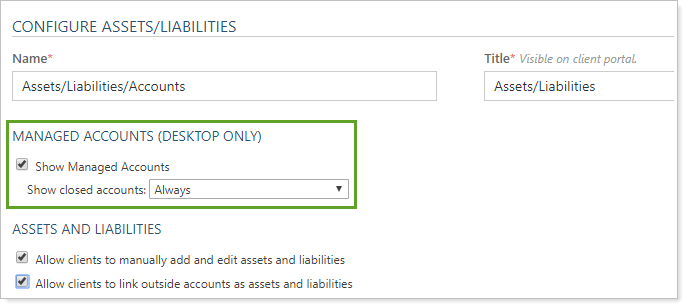

New Client View Settings to Configure the Assets & Liabilities Page

When you edit the client view, you'll notice the new Managed Accounts (Desktop Only) settings section. Use these settings to include regular financial accounts on the Assets & Liabilities page and set how to display them.

The new Assets & Liabilities page is only available for the desktop version of the client portal. Assets and liabilities functionality in the mobile app remains the same.

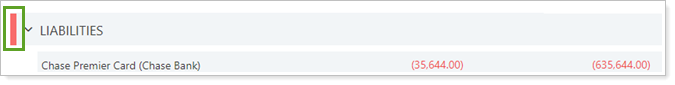

Greater Display and Configuration Control in the Net Worth Report

Every now and then, reports need dusting off and freshening up. This release, it's the Net Worth report's turn. We modernized the look a bit by moving the color bar off to the left:

At the same time, we've heard your requests and added settings that give you greater control over the Net Worth report display.

The Information You Want, Where You Want It

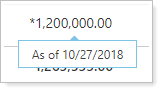

Most financial documents follow the standard of subtotaling columns at the bottom of individual sections. This release adds Display total at bottom so you can format the Net Worth report to look a little more familiar by moving subtotals to the bottom of each section.

In addition, an asterisk now marks any asset or liability where the value as of date doesn't match the report as of date. This helps you identify values that may not be current.

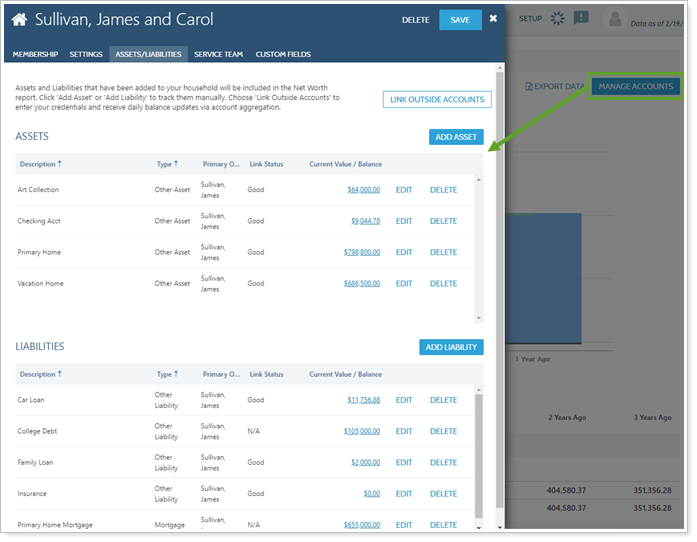

Direct Access to Edit Household Assets and Liabilities

If you're like us, you've probably looked at a Net Worth report and realized you needed to update something about an asset or liability. Now you can save time by editing assets and liabilities directly from the report. The new Manage Accounts button opens the Household's Assets/Liabilities panel without ever leaving the Net Worth report page.

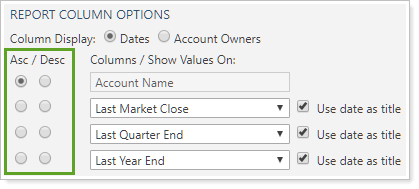

Alphabetical or value Column sorting

When you add a Net Worth report to the client portal, you want to tell the story of a client's financial growth and show your value as an advisor. Part of telling that story is organizing the report the way you want. That's why we've added further controls over column sorting, allowing you to sort accounts, assets, and liabilities by any of the columns included on the dynamic and client views Net Worth report.

For example, you can show clients a report with their accounts, assets, and liabilities sorted from largest to smallest value for a certain date, while another report is organized alphabetically by account name.

To organize columns, use the new Asc / Desc setting. You can only choose one sort option for each report.

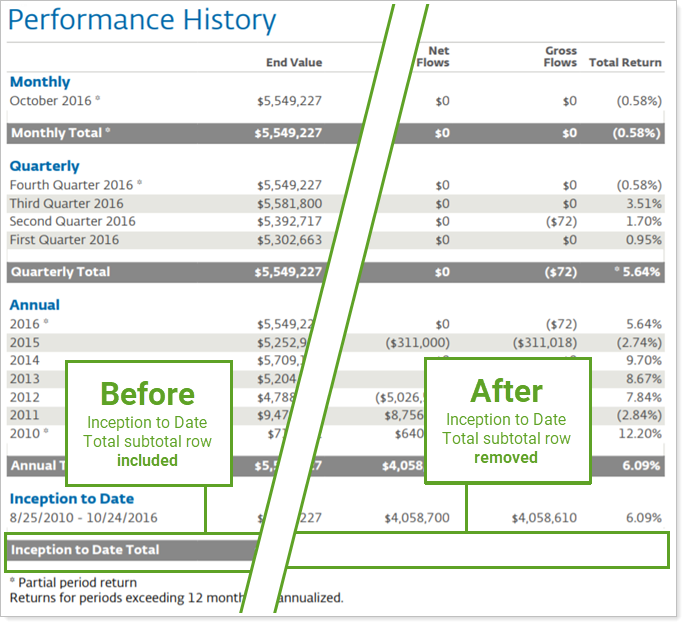

Performance History Report Inception to Date Subtotal Row Removed

Last release, we expanded the Performance History report's subtotaling capabilities to include values and returns. Some of you commented to us that, for the Inception to Date report period, the subtotal row duplicated the same data already presented. We heard your comments! You may have noticed that we removed the Inception to Date Total row from all Performance History reports before the end of the first quarter in 2020. You don't have to do anything to remove the subtotal row, and none of the other sections' subtotal rows changed.

Expanded Composite Reporting Saved Search Filters and Clarified Bulk Report Behavior

Composites allow your firm to demonstrate Global Investment Performance Standards (GIPS) compliance within Tamarac. Because setting up and maintaining composites is already challenging enough, we've made a few improvements that will help make your GIPS reporting smoother and more intuitive.

New Composite Saved Search Filters

When you run a composite saved search, you want the search to use the composite time series end date instead of the current as of date. With this release, we have enhanced two saved search filters to be smarter about end dates:

-

Asset Allocation Within or Outside Tolerance: Examines the account’s holdings and target allocation on the time series end date to find accounts where the asset allocation status is within or outside of tolerance.

-

Custom Field Effective Date: Shows accounts that include custom field effective date with respect to the time series end date.

For more information, see Composite Saved Searches.

Clarified Bulk Report Setting Behavior

We heard your confusion around how the Include Accounts With No Composite Membership check box worked and we've updated it to behave more predictably. Now when you select the check box, your bulk report includes accounts that meet both these criteria:

-

The account was open before a composite was run, but it wasn't included in a composite.

-

The account was not a member of a composite on or before the report as of date, even if it became a member of a composite after the report as of date.

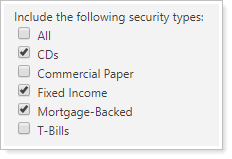

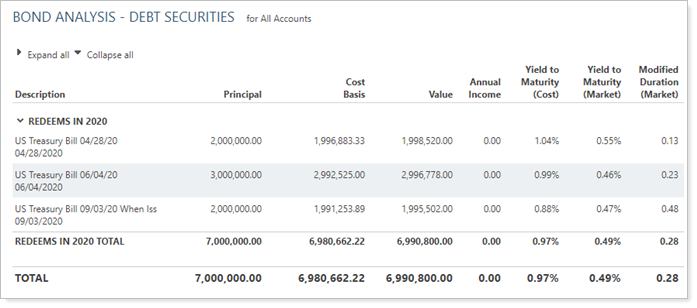

Include Additional Debt Securities in Reports

Debt securities provide an important balance in a diversified portfolio. Many of you have asked for more in-depth reporting on debt securities, and we heard you! With this release, Holdings reports will include yield and duration calculation for commercial paper and T-bills. Better yet, you can include debt securities on Bond Analysis reports.

On the Bond Analysis report, when you select Commercial Paper or T-Bills in Include the following security types, the report includes any security with a Security Type of Commercial Paper or T-Bill.

Integrations

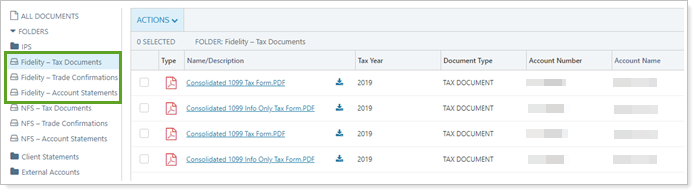

Automatically Access 1099s and Other Fidelity Documents in Your Advisor Document Vault

Every month, quarter, and year end, Fidelity sends out statements. At tax time, Fidelity sends tax forms. Every time you trade, Fidelity sends a trade confirmation. But when a client asks for their 1099 at tax time, it can be labor intensive to log in to Fidelity and dig through PDFs until you find their form.

Tamarac eliminates this frustration by providing you direct access to tax files, statements, and trade confirmations from Fidelity or, if you use Fidelity for clearing, NFS. With this release, you will see new Fidelity or NFS folders in your advisor document vault, pre-populated with your clients' Fidelity files.

To see Fidelity files in the document vault:

-

You must have the Fidelity or NFS integration enabled. For more information, see Enrollment in Fidelity Wealthscape Integration.

-

You may need to enter Fidelity credentials in Tamarac if you haven't done so recently.

This integration works with both Fidelity and Fidelity NFS, if you use Fidelity for clearing. It is only available for advisors.

Productivity

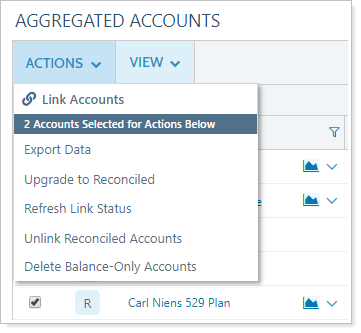

Enhance Productivity With Multi-Edit for Aggregated Accounts

Multi-edit is a time-saving tool that enhances your productivity throughout Tamarac by allowing you to apply the same change to multiple accounts at one time. For example, if you need to change the same benchmark on several accounts, you can select all those accounts and make the change once. You can multi-edit Households, clients, and securities, too. Now the Aggregated Accounts page joins the multi-edit club.

With this release, you can use multi-edit to complete Aggregated Account page actions like upgrading balance-only or APD accounts, refreshing link status, and unlinking or deleting linked accounts.

All firm administrators automatically receive access to multi-edit actions on the Aggregated Accounts page. Other users must have permissions added before they can use these new multi-edit actions.

For more information about the Aggregated Accounts page, see Using Views and Filters on The Aggregated Accounts Page.

Enjoy a Speedier Net Worth Report

We've made significant improvements to the Net Worth report under the hood. As a result, you may notice faster loading and response times when using the dynamic Net Worth report.

Faster Daily Sync

As part of our continuing commitment to enhancing your reporting experience, we've made some under-the-hood improvements that will make your daily sync faster and more reliable.

Learn More - Watch the Release Video