Contents

Reporting

Billing: New Option to Prorate New Accounts Added Between Billing Periods

Billing: New Option to Prorate New Accounts Added Between Billing Periods

Note

Prorate new accounts using number of days in period is only available when billing in arrears. It is not available when billing in advance or when using average daily or monthly balance.

When new accounts come in partway through a period, you don't want to bill as if you managed their assets for the whole time. Until now, Tamarac has offered the option to prorate new accounts based on initial flow, but the process to ensure that new accounts were prorated correctly could be cumbersome. Prorating new accounts based on initial flow meant that you had to make sure to set a billing inception date to a day the new account has value.

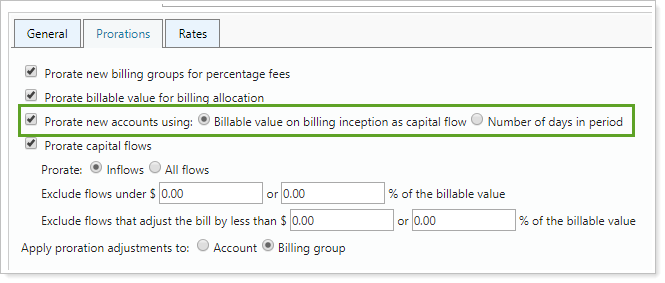

This release introduces another option for prorating new accounts when billing in arrears. Instead of prorating new accounts using billable value on billing inception as capital flow, you can choose to prorate new accounts based on the number of days in the period.

Prorating new accounts using number of days in period:

-

Eliminates the need to set a billing inception date for every new account.

-

Enhances flexibility by allowing you to prorate new accounts independent of capital flows.

-

Improves transparency on the billing statement by adding a section for new account adjustments.

Note

By default, Tamarac sets Prorate new accounts based on to Billing inception as capital flow, which calculates new account prorations as it did before. This ensures that:

-

All existing billing definitions will continue to function exactly as they always have.

-

None of your existing billing definitions or billing history will be changed with this update.

-

When you run billing in the future, Tamarac will still continue to calculate prorations as it always has.

> How the Calculation Works

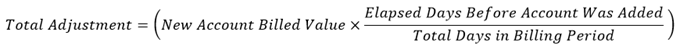

When you prorate new accounts using the number of days to prorate the fee, Tamarac calculates the new account adjustment (excluding any additional fees or adjustments) as:

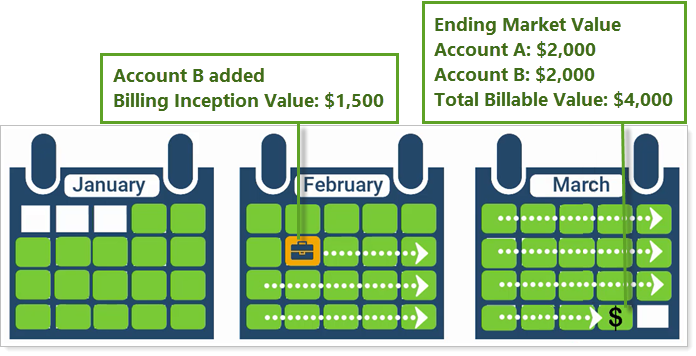

Example: Calculate by Prorating Fee Based on Number of Days

A billing group contains two accounts: Account A and Account B. Account B is a new account that was opened 23 days into the period with a $1,500 value. At the end of the billing period, each account has an ending market value of $2,000, giving the billing group a total billable value of $4,000.

Calculating the fee using a simple number of days proration produces a total fee of $8.75, as detailed below:

Billing Group Values at the End of the Period:

Account A: $2,000

Account B: $2,000

Total Billable Value: $4,000

New Account Details:

Billing Inception Value: $1,500

Billing Inception Date: 23 days into the billing period

Fee Calculation:

-

Calculate the gross fee.

-

Calculate the adjustment amount.

-

Apply the adjustment to the gross fee.

| Calculate the Gross Fee | |

|---|---|

|

Billable value: |

$4,000 |

|

Annual rate: |

1% or 0.25%/quarter |

|

Gross quarterly fee: |

$4,000 × 0.25% = $10.00 |

| Billed value for each account: | $10.00 × ($2,000/$4,000) = $5.00 |

| Calculate the Adjustment Amount | |

|

Ending market value for new account: |

$2,000 |

|

Elapsed number of days in period: |

23 |

|

Total number of days in period: |

92 |

|

Calculate adjustment amount: |

$5.00 × (23/92) = $1.25 |

| Apply New Account Adjustment to Gross Fee | |

|

Total fee: |

$10.00 - $1.25 = $8.75 |

This new calculation will not impact any other proration options applied to the billing definition. You can use the new account proration option on its own or in conjunction with other prorations.

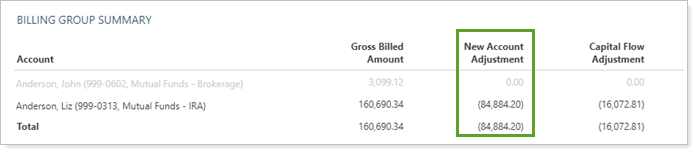

> See New Account Prorations in Billing History

Billing history reflects new account prorations in the New Account Adjustment column. This column displays the proration discount amount applied to any applicable accounts.

You can also add new account proration amount to the Account Billing History bulk report by adding the New Account Adjustment Amount column.

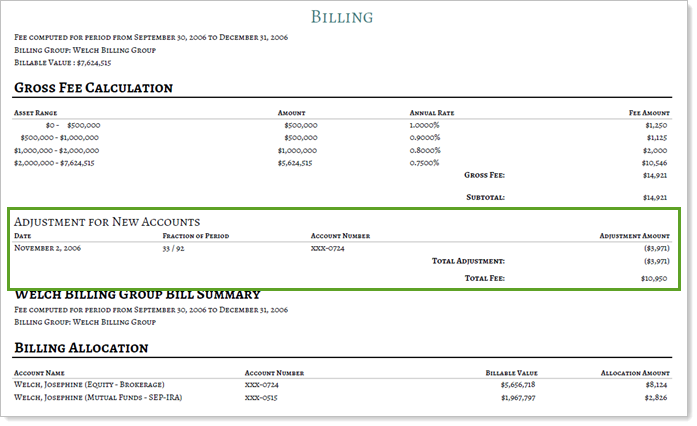

> Include the Adjustment on the Billing Statement

In the past, Tamarac swept new account adjustments into capital flows adjustments on the billing statement. While the calculation was correct, this didn't always clearly reflect to clients why the adjustment was applied.

When you use the new account proration option, billing statements with applicable new accounts display a line item that details the adjustment amount for new accounts. This provides greater transparency to clients by clearly showing which adjustments went into the total fee.

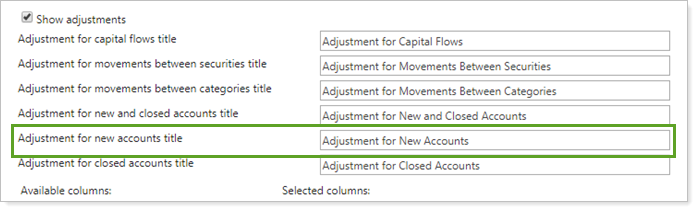

To include adjustments on the billing statement template, select Show adjustments or Show adjustment details.

New Security Capital Call Dates Upload Data Set

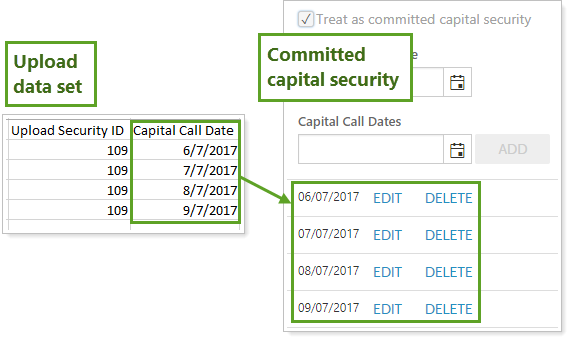

As you already know, Tamarac allows you to increase efficiency in your daily workflows. One of these efficiencies is the ability to upload data in bulk. After this release, you'll have the additional option to upload capital call dates in bulk.

When you have many clients with committed capital securities, the new Capital Call Dates upload data set allows you to add call dates to one or more committed capital securities more efficiently.

Notes

You cannot edit or delete existing call dates using the Capital Call Dates upload.

To successfully upload, include either the Symbol or Upload Security ID column in addition to Capital Call Date.

For more information on the Committed Capital report, see Committed Capital Report.

Clarified Account Analytics X-Axis Tick Marks

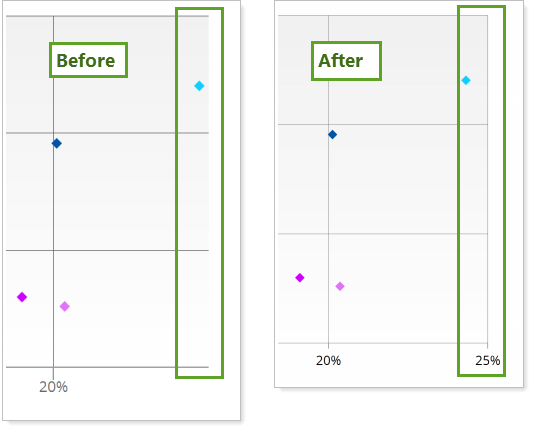

We've updated the Account Analytics Risk vs. Return chart to make it easier to interpret results that land on the right side of the chart. Previously, the right side of the chart appeared cut off, making results that fell into that section ambiguous. Now the chart includes a clear final x-axis value, tick mark, and closing line, ensuring that you can readily interpret all data.

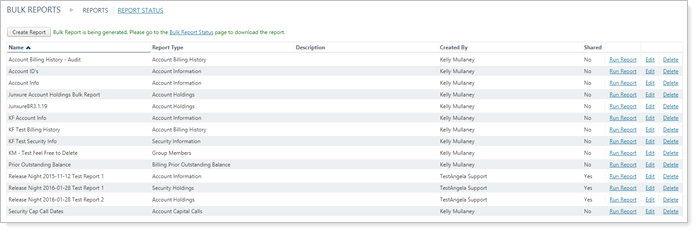

Alternating Row Colors on the Bulk Report and Bulk Report Status Pages

We heard you when you told us that it's sometimes difficult to track columns and rows across bulk report pages when you have many items listed. That's why, with this release, we've made it much easier to scan the Bulk Reports and Bulk Reports status pages by adding alternating colors to rows.

Tip

To sort by columns by ascending or descending value, click the column header.

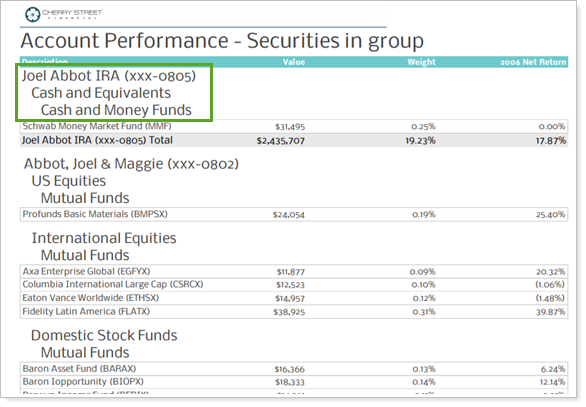

Additional Options When Grouping By Account on the Account Performance Report

As part of our commitment to enhancing your reporting experience, we've enhanced the grouping options on the Account Performance report. Before, if you wanted to Group by account, you couldn't group by the second and third grouping levels. Now you can group by account and also group up to two additional grouping levels.

This allows you to avoid having to create separate pages for each account on the Account Performance report. Instead, you can group accounts in-line with additional grouping options added below.

Integrations

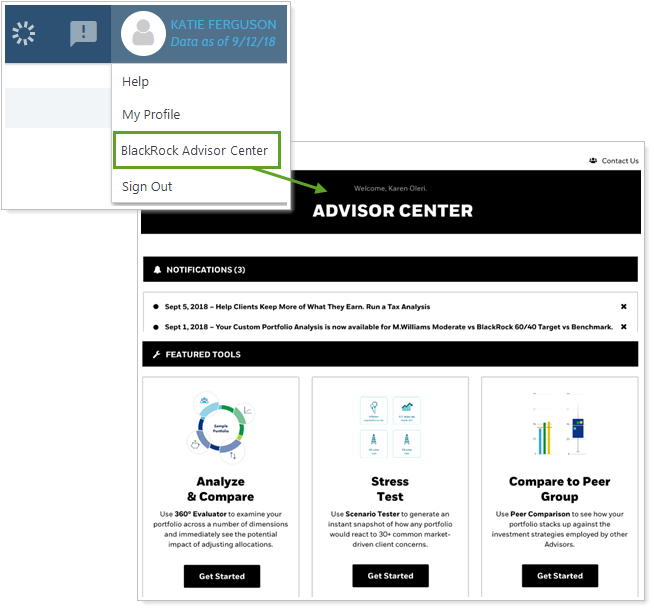

Single Sign-On From Tamarac to BlackRock Advisor Center

Single Sign-On From Tamarac to BlackRock Advisor Center

Coming soon, Tamarac will introduce single sign-on from Tamarac into the BlackRock Advisor Center as the first step in our integration partnership. This partnership, which will integrate BlackRock Aladdin Wealth Tech’s technologies into the Tamarac platform, enhances the investment technology solutions available you and your investor clients.

The BlackRock Advisor Center is a free tool for advisors that provides web portal access to practice management solutions such as scenario analysis and risk assessments. This single sign-on streamlines your workflows by reducing time spent logging in between systems.

To access the BlackRock Advisor Center from Tamarac, hover your mouse over your name at the top of the page and click BlackRock Advisor Center.

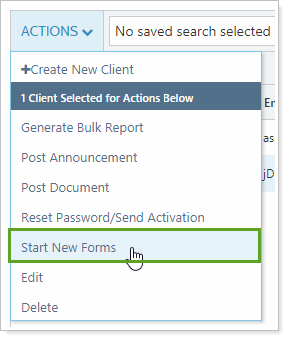

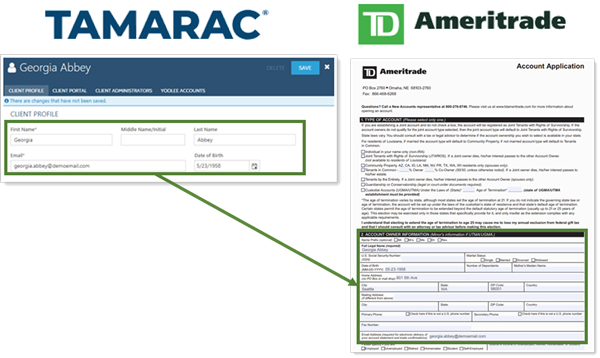

Coming May 2019: Open New TD Ameritrade Accounts through Tamarac

Coming May 2019: Open New TD Ameritrade Accounts through Tamarac

Note

The TD Ameritrade Start New Forms integration will be available starting in June, 2019.

When it comes to opening new accounts, filling out the paperwork is often time consuming. You have to look up and enter the account owner's personal details—and it can be easy to make a typo when completing custodial forms. That's why we've added the Start New Forms feature.

With Start New Forms, opening new accounts has never been easier. Instead of manually entering client information, you can securely import Tamarac client and Household data directly into TD Ameritrade Institutional's Veo One® forms directly from the Clients/Client Portals page.

Client information sent from Advisor View to TD Ameritrade Institutional's Veo One® platform includes:

-

Primary account owner information: First name, middle name, and last name from the client record

-

Personal information: Date of birth from the client record

-

Contact information: Email address from the client record and street/mailing address from the associated Household

Administrators automatically receive access to Start New Forms if your firm has TD Ameritrade Institutional's Veo One® integration enabled. Other users can be granted permission to access this feature under Roles, then Accounts | Clients/Client Portals.

Enrollment

This feature must be turned on for your firm. If you're interested in having Start New Forms enabled, contact your Support Team.

Before you can take advantage of Start New Forms, you must have TD Ameritrade Institutional's Veo One® integration enabled. For more information about enrolling, see TD Ameritrade Veo Integration.

Easier Login to Tamarac from Single Sign-On Services

For those of you who use single sign-on (SSO) services to manage logins, including the Tamarac login, we've made it a little easier to access Tamarac. Previously, Tamarac requires users—you and your clients—to enter credentials the first time users log in to Tamarac through an SSO—credentials that you and your clients may not know.

To make it easier to use SSO services to log in to Tamarac, Tamarac now recognizes users by email address on first login, skipping the request for credentials. If this fails, you and your clients will still have the option to enter credentials to complete the first login.

Notes

To use this integration, contact Tamarac Account Management at TamaracAM@envestnet.com.

Services

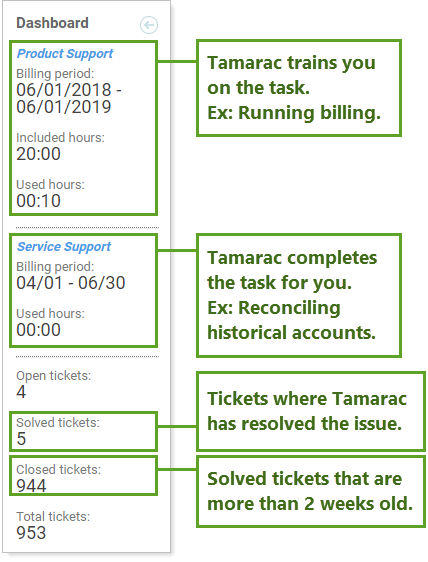

More Granular Support Hour Data Available on the Updated Support Management Dashboard

One reason you love Tamarac is our exceptional support. You can call us to get a solid answer for anything Tamarac-related, ranging from running a report to dealing with underlying data issues. Now it's easier for you to tell how much of your support time goes to product-related issues and how much goes to service-related issues. This helps you identify where additional training might help reduce support calls.

For example, if you notice a substantial number of product-related call hours, that might indicate firm users could benefit from additional training. On the other hand, if all your support calls go to service-related issues, that could indicate that your team is contacting support to handle tasks that could be more efficiently handled internally.

> What Qualifies as a Product Support Issue vs. a Service Support Issue?

| Product Support Issues | Service Support Issues | |

|---|---|---|

| What Qualifies | Tamarac Support trains you on how to complete a task. | Tamarac Support completes the task for you. |

| Examples |

|

|

You’ll notice we’ve updated the Support Management dashboard to reflect these updates. We've added:

-

Sections to split out Product Support time and Service Support time.

-

Sections to split out Solved Tickets and Closed Tickets, to more transparently communicate with you the status of all the tickets you’ve submitted.

Notes

Product Support is tracked for the total number of annual product support hours available to your firm.

Service Support is tracked for quarterly service support hours used. If you want to review total annual hours used, consult your Tamarac invoice for previous support service hours used, or contact your dedicated Tamarac Support.

You can access the Support Management dashboard through the Support & Training Center.

Learn More - Watch the Release Video