Contents

Introduction

Models are the basic building blocks used to build and maintain your clients' holdings. The models you create serve as a framework that can then be applied to and customized for your clients, allowing you to manage the securities that are bought and sold to maintain your clients' investment objectives. For more information on models basics, see Introduction to Models.

Goals and Ranks in Models

After building your models, you may want to add further complexity to your models. Advisor Rebalancing allows you to build in flexibility as to how your models are allocated using goal and rank-based logic within your models.

Goal-Based Models

During a rebalance, goal-based models focus on obtaining the goal position for individual securities. A multi-tiered model structure allows you the flexibility to customize your models with a mix of both rank and goal-based models. Within that structure, a goal-based model gives a definite allocation mix over time.

Example

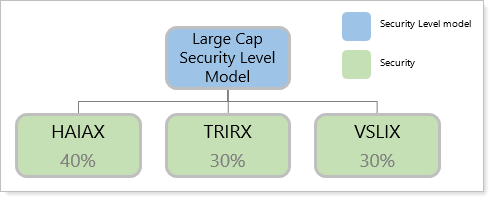

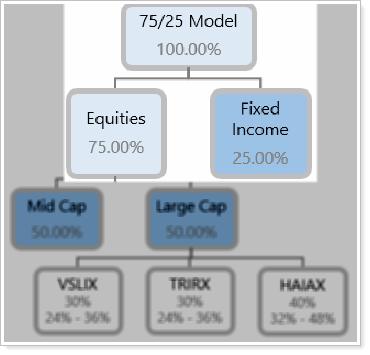

You build the Large Cap Security Level Model as a goal-based Security Level model. The model has the following allocations:

In this goal-based model, HAIAX is 40% of the model, and TRIRX and VSLIX are each 30% of the model.

During the rebalance process, Advisor Rebalancing will recommend trades to get Large Cap Security Level Model back to these allocation goals if they've deviated so that the allocations for all three securities match the targets you've set.

During a rebalance, Advisor Rebalancing will recommend trades to get goal-based models back to these exact target allocations or as close as it can.

Rank-Based Models

Rank-based models give priority to achieving the target for the asset class or Security Level model rather than all the individual securities within the model. You can classify a model as a rank-based model and then assign ranks—anywhere from 0 to 999—within that model. When a rank-based model is rebalanced, the targets are adjusted based on the current holdings, the rank, and the targets of the security or model.

Ranks give your models flexibility. You can blend Security Level models that use ranks with Security Level models that don't use ranks. You can also use ranks to accommodate legacy positions and restricted securities; ranks allow you to keep these positions in your models and have the holdings in legacy securities offset the other securities in the model.

Example

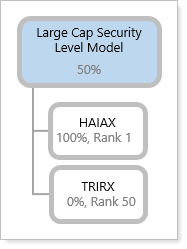

You create Large Cap Security Level Model with the following allocations:

Today, you are going to rebalance an account which contains this model. The target allocation for Large Cap Security Level Model is 50%. It's current allocation is 50%, so Large Cap Security Level Model is at its target. These are the current allocations for the securities in the model:

| Security | Target Allocation | Current Allocation | Adjusted Target |

|---|---|---|---|

| HAIAX | 100% | 95% | 95% |

| TRIRX | 0% | 5% | 5% |

As you can see, Advisor Rebalancing adjusts the targets to accommodate the current allocations. Because this is a rank-based model, and the current allocation for Large Cap Security Level Model is at its target of 50%, no buys or sells will be recommended.

During rebalances, Advisor Rebalancing examines ranks and adheres to these guidelines:

-

If a model is underweight, Advisor Rebalancing will prioritize buying securities with the numerically highest rank.

-

If a model is overweight, Advisor Rebalancing will prioritize selling securities with the numerically lowest rank.

Situations to Use Rank-Based Models

These situations are best suited for rank-based models:

-

If your investment strategy has a priority in achieving a target position for a category of securities, such as an asset class, instead of achieving a target for specific securities.

-

If you have many different securities that can fill a target allocation in a portfolio.

-

If your models contain many securities that are restricted or considered legacy positions.

Rules for Rank-Based Models

Consider the following rules for using rank-based models:

-

Ranks cannot be negative. You can use ranks from 0 to 999 where 0 is the highest sell priority and 999 is the highest buy priority. Ranks don't have to be sequential.

-

Securities can have the same rank in a Security Level model. In Allocation models, submodels can have the same rank as well.

-

If the rank-based model is underweight, you will generally only see buys up to the model targets, not buys and sells between the securities. If that model is overweight, you will generally only see sells.

-

Your highest ranks are generally reserved for securities or models with the highest targets.

Static and Dynamic Logic

Security Level models can be created with either static or dynamic targets. While the majority of models will be static, dynamic targets can be useful in some circumstances. When a model has a dynamic target, Advisor Rebalancing will adjust target weights based on the performance of securities in the model.

Static

Static models have targets that remain consistent, regardless of the performance of the securities within that model. While you have the option to adjust target allocations for your models in the future, a static model's allocations will stay the same.

Example

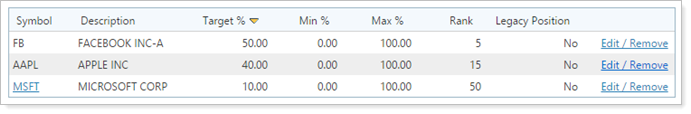

You create Large Cap Technology as a static Security Level model.

Over time, prices for these securities will change. However, if one of these securities has significant increase or decrease in price, its Target % will remain the same.

Dynamic

Dynamic models—sometimes called share-based models—use dynamic targets that are tied to the share price and adjust based on market movement each day. You may want to choose this option if you have a momentum investing strategy and you want the allocations of the securities in the model to track with performance.

Example

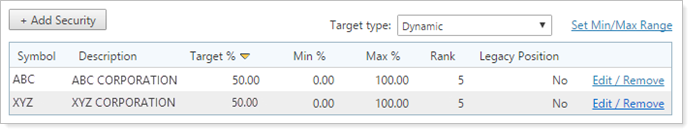

You create Large Cap Technology as a dynamic Security Level model.

Over time, the prices of ABC and XYZ will change. Because the target is dynamic, the allocations for those securities will adjust based on changes in price. If both ABC and XYZ were priced at $50 a year ago, but their prices became $60 and $40 as of yesterday, Large Cap Technology will adjust accordingly:

| Security | Price 1 Year Ago | Target % 1 Year Ago | Price Today | Target % Adjustment |

|---|---|---|---|---|

| ABC | $50 | 50% | $60 | 60% |

| XYZ | $50 | 50% | $40 | 40% |

Best Practice

Dynamic models are usually used with individual stock models without legacy securities or restricted securities.

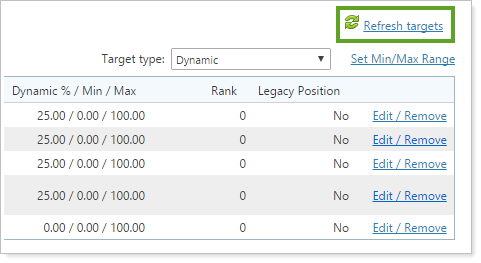

Refreshing Targets in Dynamic Models

If you have a dynamic Security Level model, you can refresh the targets in your model manually. To retrieve the latest security price and adjust the targets accordingly, click the Refresh Targets link.

Keep the following in mind when refreshing targets for a dynamic model:

-

The dynamic values replace the model target and min/max range.

-

Any changes are applied when the model is saved.

-

Saving the model without first refreshing the targets resets the dynamic targets.

For more information, see Create, Edit, and Delete Security Level Models.

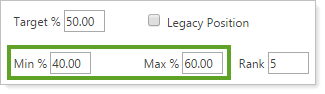

Min/Max Logic in Models

You can add minimum and maximum—referred to as min and max—values to models. These values create a tolerance band around the target allocation. The min becomes the minimum tolerance for that security or model and the maximum is the maximum tolerance for that security or model. This allows you to set allocations more loosely and reduce the number of trades within an account.

You can use min and max tolerances to do the following:

-

Monitor accounts and take action on those which have gone outside of their tolerances.

-

Allow for some volatility while reducing the overall number of trades to only those times when the model has gone outside of its tolerances.

-

Minimize turnover and fees.

-

Allow for tolerance-based rebalancing opportunities rather than calendar-driven rebalancing.

Setting min/max values is appropriate for models where drift among the allocations in those models is acceptable. This allows you to maintain your investment philosophy while reducing the number of trades in the account needed to maintain that philosophy.

In some cases, maintaining a more strict model allocation is appropriate and isn't a good use for using min and max tolerances. Consider this example:

Example

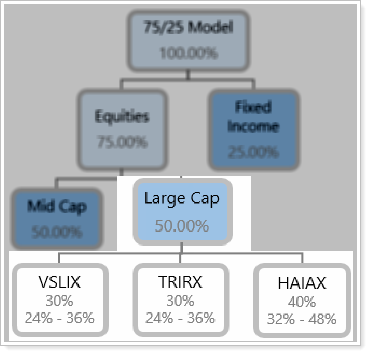

You assign a client's account to a model that is a mix of 75% Equities and 25% Fixed Income:

Due to the agreement you have with the client, as well as the client's risk tolerance and stated preference, the client's account must keep this ratio of securities at 75/25. For this tier of the client's model, you do not want to use min/max tolerances.

Within the Equities model, you've added a submodel to represent large cap securities. This model contains three securities:

Large Cap is allocated to 50% of Equities. The individual securities within Large Cap have allocations as well as min and max values. This is because you don't mind if the allocations for the securities within Large Cap drift within their tolerance band, provided that the overall model maintains its allocation. In this case, you do want to use min/max tolerances.

Best Practices

-

Begin setting your min/max range at 20% deviation in either direction. For example, if a security has a target allocation of 40%, your range would be a min of 32% and a max of 48%.

-

We recommend not placing min/max allocations into rank-based models. For example, you have allocations to similar securities and, since both are similar, you'd likely not want to sell out of one to purchase another.

Where Do I Go Next?

Now that you know about the core concepts for using models to your advantage, you can learn about more advanced settings and uses for your models. For more information on advanced model logic, concepts, and strategies, see Advanced Model Concepts.