# | A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

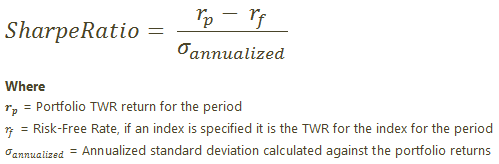

Sharpe Ratio is a risk-adjusted measure developed by Nobel Laureate William Sharpe. It is calculated by using standard deviation and excess return to determine reward per unit of risk. The higher the Sharpe Ratio, the better the portfolio’s historical risk-adjusted performance.

The Sharpe Ratio can be used to compare two portfolios directly with regard to how much excess return each portfolio achieved for a certain level of risk.

The Calculation

When Sharpe Ratio uses Net or Gross Returns

On the Account Analytics report, you can control whether the calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.