# | A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

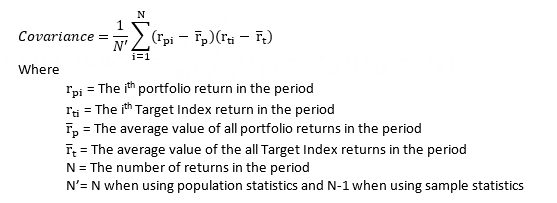

A measure of the degree to which returns on two risky assets move in tandem. A positive covariance means that asset returns move together. A negative covariance means returns move inversely.

To find out if your firm is using population or sample statistics, please contact your dedicated service team.

The Calculation

When Covariance uses Net or Gross Returns

On the Account Analytics report, you can control whether the calculation uses net or gross with Show Returns As (Net or Gross).

When you run composites, the Composite Statistics report reports only on gross returns. For more information, see Composite Statistics.