Contents

Introduction

The Tactical Rebalance is a model-specific rebalance that lets you choose which models you want to rebalance, either Security Level models or Allocation models, and rebalance within that model and all submodels underneath it. Depending on how your models are configured, you can tactically rebalance specific asset classes or sectors without completing a rebalance on the entire portfolio.

Rebalance Logic

The Tactical Rebalance is specific to the models you choose to rebalance, not to overall portfolios. As part of the rebalance process, you'll first choose the accounts in which you want to perform the Tactical Rebalance. Next, you'll choose the models you want to rebalance, and then adjust additional settings to meet your particular goals.

Based on the accounts, models, and settings you chose, Advisor Rebalancing will then run the rebalance on the chosen models and any submodels. The default settings will be to rebalance those models back to model weight, as in a Full Rebalance, or you can choose to perform a Min/Max Rebalance on the selected models. You can also choose to preserve current model allocations, or you can trade models back to their target allocations.

Example

You have an account which is assigned to a 60/40 model, but you would only like to rebalance the Equities submodel. Equities is currently overweight at 65% instead of its target 60% allocation.

You'd like to leave Equities at 65% at the moment because it's been performing well, and you don't want to sell out of the securities at the moment.

If you perform a tactical rebalance on the Equities submodel and select the Use current weight option, the Equities target will be temporarily adjusted to 65% percent of the account— essentially rebalancing the account back to the underlying model goals while still preserving the current split between asset classes.

Your settings also determine how cash will be treated in the tactical rebalance. For more information on these specific settings, see Tactical Rebalance Settings.

Notes

If you perform a Tactical Rebalance on the UNASSIGNED model, Advisor Rebalancing will sell all unassigned securities and ignore all cash-related settings, except for Invest excess cash.

When To Use

The Tactical Rebalance can be used strategically to achieve certain goals for your models. It's not available as a default rebalance type.

Here are some situations where a Tactical Rebalance is useful:

-

You change the target percentages for securities in a particular model; you can then use the Tactical Rebalance to bring clients using this model back to their model goals without rebalancing the whole account.

-

You remove a security from a model or replace that security with another; the Tactical Rebalance can bring the model back to its model goals.

-

If you would like to sell the unassigned securities within the account, run the Tactical Rebalance on the UNASSIGNED model.

Applicable Settings

When completing the Tactical Rebalance, Advisor Rebalancing will ask you to choose additional options. In addition, some system and account settings will affect the Tactical Rebalance process. The following is a summary of the various settings that can affect a Tactical Rebalance.

Tactical Rebalance Settings

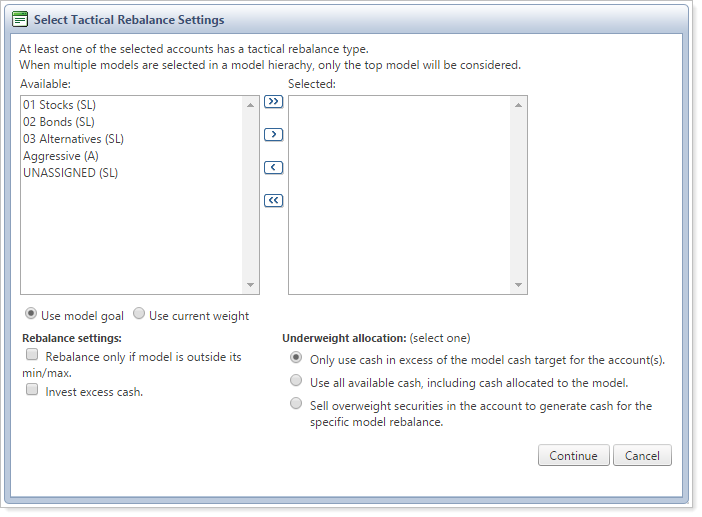

The following settings can be seen in the Select Tactical Rebalance Settings dialog box.

| Available Setting | More Information |

|---|---|

|

Model Selection |

|

|

Available |

Lists only the Security Level and Allocation models that are within the accounts you selected. |

|

Selected |

Lists the models you've added in which you'll complete the Tactical Rebalance. |

|

Use model goal |

This option completes the tactical rebalance on all models that are selected, including any submodels of the models you've selected, and then rebalances the selected models back to their target weights. |

|

Use current weight |

This option completes the rebalance and keeps the current weight of the selected model. Any submodels of the selected model or models will be rebalanced relative to the parent model. If the selected Allocation model or any of its submodels are outside their min/max tolerance ranges, Advisor Rebalancing will rebalance the selected models back to their target weights. This option has the potential to create fewer trades and can be good for situations where the client's holdings are performing well and you don't necessarily want to sell out of those securities in order to rebalance. |

|

Rebalance Settings |

|

|

Rebalance only if model is outside of its min/max |

When selected, the models you select will only be rebalanced if the model's holdings within the selected accounts are outside the model's min/max tolerances. |

|

Invest excess cash |

When selected, this option causes excess cash in the account—for example, cash generated from selling securities within the rebalanced model or excess cash not allocated to a model or cash reserves—to be allocated towards buying underweight securities in all models within the accounts selected. |

|

Underweight Allocation |

|

|

Only use cash in excess of model cash target for the account(s) |

When selected, cash will only be used if there's cash in excess of the amount needed to meet the targets for any cash within your models. This is the most restrictive option. |

|

Use all available cash, including cash allocated to the model |

When selected, Advisor Rebalancing will use all cash in the account to rebalance the selected models as close to their targets as possible with respect to total account value. This may leave one or more unselected models in the account underweight if the account has cash available for trading. |

|

Sell overweight securities in the account to generate cash for the specific model rebalance |

When selected and the selected model is underweight and the account does not have extra cash, the account will sell the most overweight securities down to their goals to raise the cash necessary to bring the selected underweight models to their targets in the selected accounts. This is the least restrictive option. |

System and Account-Level Settings

The following system, account, and security settings can affect the Tactical Rebalance:

| Setting | More Information |

|---|---|

|

System Settings: Rebalance Settings |

|

|

Choose how Advisor Rebalancing uses cash during the rebalance. |

|

|

Allows you to define the order in which the rebalance will generate sells. |

|

|

Allows you to define the order in which the rebalance will generate buys. |

|

|

This settling allows you to adjust how Advisor Rebalancing determines which trades to recommend. The larger the improvement percentage, the more trades the system can recommend as there is a wider range to meet. A smaller improvement percentage becomes more restrictive and could recommend few trades as there is a more narrow range to meet. |

|

|

Tells Advisor Rebalancing how to calculate deviation away from model targets when determining buy and sell order. Absolute deviation uses the absolute calculation of deviation. Relative deviation calculates deviation relative to the parent model's target. |

|

|

Account Settings: Rebalance & Trade Settings |

|

|

When Yes, Advisor Rebalancing temporarily ignores model ranks and rebalances to your investment targets at the lowest possible tax cost to the client. It will then ignore ranks and sell losses first, followed by securities with no tax consequences, and then finally, it will sell gains. |

|

|

These can be set as either dollar amounts or percentages. Advisor Rebalancing applies the greater of these two and will prevent a trade if it doesn't meet these requirements. |

|

|

These settings apply to all securities held in the account and a rebalance can cause a recommendation to liquidate a security if the resulting trade would cause the security to fall under the minimum holding size set at the account level. |

|

|

When Yes, this setting prevents any trading in an account. When an underlying account in a rebalancing group is on hold and the amount of an asset class it holds is above the max for the rebalancing group, the rebalancing group won't complete the rebalance in tolerance. |

|

|

The rebalance adheres to account-specific restrictions like Range to Hold and any Buy/Sell Restrictions. |

|

|

Securities |

|

|

The rebalance adheres to security-specific restrictions like Hold Do Not Trade. |

|

|

The rebalance adheres to security-specific custom settings like Custom round lot or Custom trade price. |

|

Best Practice

It is important to review any warnings under Rebalance Status Messages on the Rebalance Summary. These warnings let you know about any applicable account, security, or system-level settings.