Contents

|

|

Introduction

Directed trades allow you to make targeted trades outside the constraints of a rebalance. Below are several strategies you can use with directed trades.

For more information on how to complete a directed trade, see Directed Trades Process.

Using Saved Searches

Often, the first step in the directed trades process is identifying accounts in which you want to complete a directed trade. Saved searches allow you to identify and save a list of those accounts based on search criteria that you set.

Here are some useful saved searches you might use:

-

Accounts that contain a specific security; for example, all accounts with a position in AAPL

-

Accounts with a specific Allocation model that has recently been changed

-

Accounts containing a specific security level model

-

Accounts with a certain amount of excess cash

Once you create a saved search, you can also share that search with others or save the search to use in the future. You can then use the saved search to apply accounts to your directed trade.

For more information on creating saved searches as well as examples of commonly used saved searches, see Working With Saved Searches.

Swapping Securities

There may be situations where one security is no longer appropriate for your strategies and a security swap may be necessary where all of that security is sold and the proceeds are used to purchase a more appropriate security. In this case, using a Linked Trade directed trade to swap the security can be useful.

Example

Some of your clients have the ABCDX fund in their portfolios. After examination, it appears that WXYZX fund, while similar to ABCDX, has better performance and will better fit your clients' needs.

First, you create a saved search to find those accounts that contain ABCDX. Next, you create a directed trade using the Linked Trade type to sell ABCDX and purchase WXYZX with those proceeds. You use the saved search you already created, which identifies clients holding ABCDX, and apply it to the directed trade, allowing you to execute the trade in the relevant accounts.

In some cases, a rebalance is more appropriate. For example, a model was changed so that one security was removed and another was put in its place. In this case, a tactical rebalance may be more suitable.

Selling a Single Security From All Accounts

There are many reasons why you would want to sell a single security from all accounts, and Directed Trades allow you to quickly and immediately act to sell a security in every account where it's held. In Advisor Rebalancing, this is a two-step process. First, find all accounts that contain that security. Second, sell out of that security using a Directed Trade.

Example

You notice some troubling news reports lately that ABC Corporation (ABC) is being investigated for fraudulent accounting practices. Some of your clients have ABC in their portfolios, and because its value is falling and it appears to no longer be a sound investment, you'd like to identify all of your clients who hold ABC and then sell their shares and invest those dollars into a more sound investment.

First, you can create a saved search to identify all clients who hold ABC. Next, you can use that saved search within a Directed Trade to sell all shares of ABC.

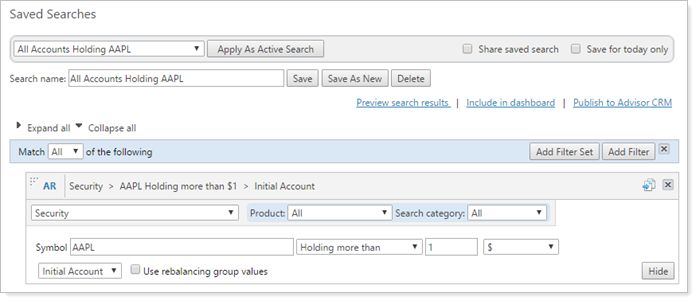

Create a Saved Search to Find all Accounts With a Security

To complete the saved search described in the above example, follow these steps:

-

On the Accounts menu, click Saved Searches.

-

Click Add Filter.

-

Select the Security search option.

-

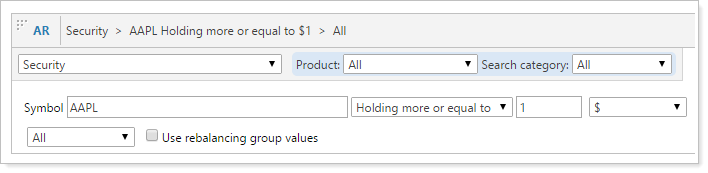

Enter the Symbol and search for Holding more or equal to $1 to find all clients who hold the security.

-

Give the search an appropriate name in the Search name field.

-

In the Match all/any of the following list, select All.

-

Click Save.

Use Your Saved Search to Create a Directed Trade

Next, use the saved search you created to apply a directed trade so you can sell all of that specific security.

-

On the Rebalance & Trade menu, click Directed Trades.

-

In the Trade Type list, click Sell and then click Create.

-

Create the directed trade using the following settings:

-

Give the trade a meaningful name in the Description field.

-

In the Security (Symbol) field, add the symbol to be sold.

-

In the Quantity Type list, choose % of Security Value.

-

Enter 100 for the quantity, indicating you’d like to sell 100% of the security’s value.

-

-

Click Create.

-

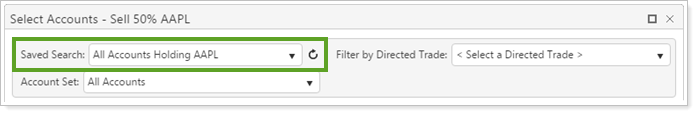

Once you’ve created the trade, add accounts to the directed trade. Click the blue link under the Accounts column.

-

In the Saved Search list, select the saved search you created above.

-

Select all of the accounts by clicking the check box next to the Account Name column.

-

Click Save & Apply.

Directed Trades Using Security Substitutes

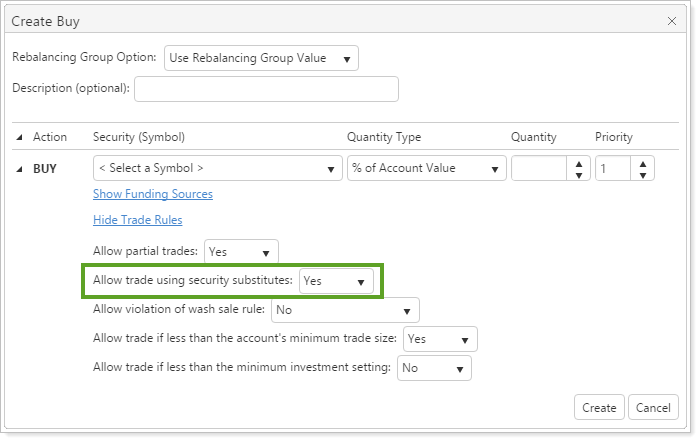

When placing a directed trade for a security with security restrictions, Advisor Rebalancing can perform the trade action using substitute securities if substitutes are available for the security and you have enabled the Allow directed trade using security substitutes option.

Best Practices

-

Use security substitutes when selling, but not while buying securities through directed trades.

-

Security substitutes can be used for similar mutual fund share classes where either the mutual fund in the model or a substitute fund would achieve similar goals.

-

This option is useful for trading in accounts with restricted securities; it allows you to complete a directed trade in multiple accounts, even accounts with restrictions.

A directed trade to buy a security with restrictions may result in purchasing the security’s substitute, if possible, just as a directed trade to sell a security with restrictions may result in selling the security's substitutes as shown in the above example.

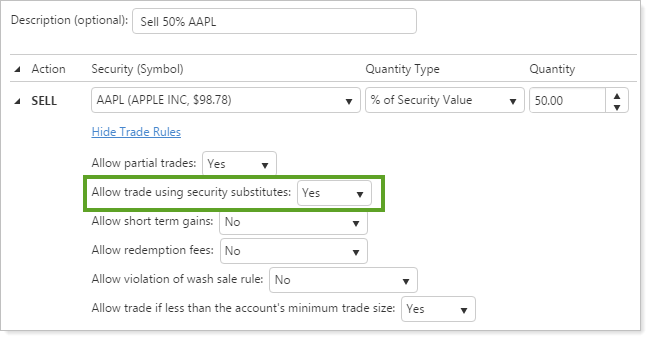

To use substitute securities for directed trades, select Yes in the Allow trade using security substitutes list.

For more information on creating substitute securities, see Security Substitutes.

Example

Assume IBM and MSFT are substitutes for AAPL. You have an account with the following goals, ranks, and amounts held:

| Security | Rank | Goal | Amount Held |

|---|---|---|---|

| AAPL | 3 | 100% | $10,000 |

| MSFT | 2 | 0% | $10,000 |

| IBM | 1 | 0% | $10,000 |

| Total value held | $30,000 | ||

You create a directed trade to sell 50 percent of AAPL with the Allow trade using security substitutes option set to Yes.

If you didn't enable the security substitutes option, this directed trade would result in selling $5,000 of AAPL which is 50% of the value held.

With the security substitutes option enabled, the directed trade will result in selling $10,000 of IBM—the highest ranked substitute is sold first—and $5,000 of MSFT, the next highest ranked substitute. The total of the sell would be $15,000 or 50% of the value of AAPL and its substitutes MSFT and IBM, which is $30,000.

Trading a Single Security for Tax Management Reasons

A directed trade can be used as a tax management tool when a single security presents an opportunity to harvest a loss or a gain within an account. The Sell Losses and Sell Gains directed trade types allow you to find lots with losses or gains and sell that security if it meets the loss or gain thresholds you specify. For more information, see Trade Type and Quantity Definitions in Directed Trades.

Using Directed Trades vs. Rebalancing an Account

Directed trading enables you to focus on individual securities while giving you the option to trade across one or many accounts outside the constraints of a model. In some cases, like changes to your models, either a directed trade or a rebalance of the account would be appropriate.

For more information on whether to use a directed trade or a rebalance in special circumstances, see Directed Trades Versus Rebalancing.