Contents

Introduction

Legacy positions, sometimes called legacy holdings, are positions that clients have within their accounts that don't necessarily fall within your ideal models for that client's account.

Example

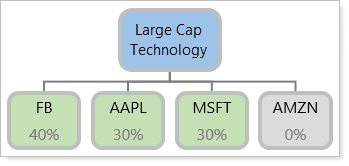

A new client opens an account with you. One of the submodels that will be assigned to his account is the Large Cap Technology Security Level model. However, the client is bringing in holdings in AMZN which is not within your model. AMZN is not in your models, so it is considered a legacy position.

The client wants to continue to hold AMZN and have it count towards allocation to Large Cap Technology. You add AMZN to Large Cap Technology and make it a rank-based model. You give the legacy position, AMZN, a 0% target.

During future rebalances, Advisor Rebalancing will examine the holdings in this model based on your settings. If the model is underweight, Advisor Rebalancing will purchase the three securities with a target. If the model is overweight, Advisor Rebalancing will recommend a sell of AMZN because of its 0% target, the lowest in the model.

Here are some examples of why an account might hold legacy positions:

-

The account holds a position with a large embedded gain and the client does not want to sell.

-

A client holds an unassigned position that is similar to a model position, like a large cap value fund similar to the large cap value fund in your model.

-

One of the positions in a client's account has a buy only or hold restriction.

Strategies to Sell the Legacy Position

As you work with clients, your clients' holdings, account types, and strategies will guide your decisions about what to do with their legacy positions. Below are the most common strategies used to sell legacy positions:

Immediately Sell the Legacy Position

Some firms prefer not to hold legacy positions in accounts because of firm policy or for efficiency reasons. In these situations, do not include the legacy position in your models. Next, you can liquidate the legacy position and reinvest the proceeds into your model targets. This can be done in one of two ways:

-

Rebalance. Run a full rebalance; this will likely result in a recommendation to sell all unassigned positions. For more information, see Start the Rebalance Process.

-

Directed Trade. Create a directed trade to sell out of the legacy security entirely. For more information, see Directed Trades Process.

Gradually Sell the Legacy Position

In some cases, you might not want to sell the entire legacy position all at once. In situations where the legacy position is a large portion of the account or where the legacy position has a substantial gain, you may want to gradually sell the security by selling out of the position over time. You can also sell the position on an as-needed basis.

In these situations, do not include the legacy position in your models. Next, you can gradually sell the positions over time. This can be done in one of two ways:

-

Add Security to your Model. Place the security within a model and make it the lowest ranked security with a target of 0%. The legacy position will be sold gradually when the security level model is overweight. However, this technique only works with rank-based models.

-

Substitute. Make the legacy position a substitute for a similar position within the model. For more information, see Security Substitutes.

Sell when the Legacy position turns into a long-term gain

Most firms prefer not to take a short-term gain, especially if it matures into a long-term gain in a short period of time. In these situations, follow these guidelines to sell the legacy position as a long-term gain:

-

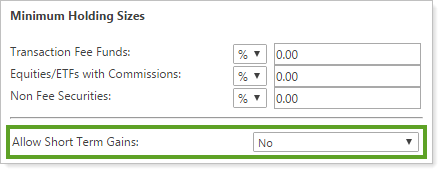

Add a Restriction. Apply a restriction within the account to prevent selling of short-term gain positions. For more information, see Allow Short Term Gains Setting.

-

Rebalance. Rebalance the account. With the account restriction preventing short-term gains in place, the legacy position with a short-term gain won't have a recommended sell, but will when the position becomes a long-term gain. For more information on the rebalance process, see Start the Rebalance Process.

Strategies to Hold or Buy the Legacy Position

As you work with clients, your clients' holdings, account types, and strategies will guide your decisions about what to do with their legacy positions. Below are the most common strategies used to hold or buy legacy positions:

Exclude the Legacy Position From Account Value

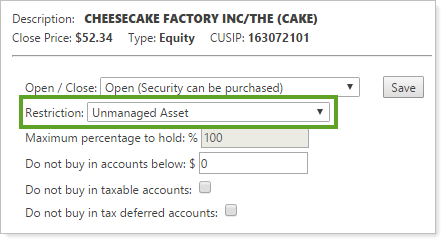

One option is to consider the legacy position an unmanaged security. This is appropriate for clients who want to hold the legacy position but the advisor doesn't want that security counted towards the account's allocations.

In these situations, do not include the legacy position in your models. Next, set the legacy position as unmanaged. This can be done in one of two ways:

-

Global Security Restriction. Set the security as Unmanaged Asset on the Restrictions page under the Securities menu. This makes the security unmanaged globally, so that all accounts holding this security will now consider the security unmanaged. For more information, see Security Restrictions.

-

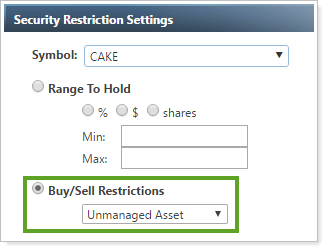

Account Security Restriction. Set the security as Unmanaged Asset on the Rebalance & Trade Settings tab on the Account Settings page. This makes the security unmanaged only for this account. For more information, see Security Restrictions Settings.

Hold The Security

In some cases, the client does not want to buy or sell the legacy position, but you may want the security to count towards the account's allocation. In these situations, apply a hold restriction to the legacy position. This can be done in one of two ways:

-

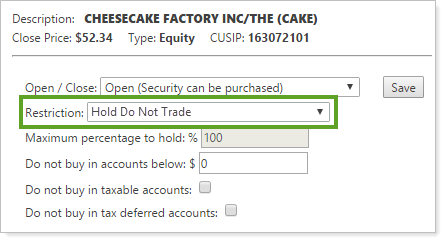

Global Hold Restriction. Set the security as Hold Do Not Trade on the Restrictions page under the Securities menu. This applies this restriction globally and all accounts holding the security will now consider the security as Hold Do Not Trade. For more information, see Security Restrictions.

-

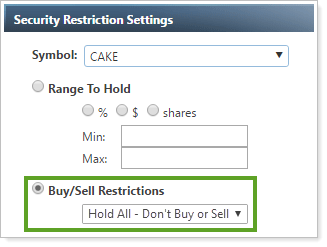

Account Hold Restriction. Set the security as Hold All - Don't Buy or Sell on the Rebalance & Trade Settings tab on the Account Settings page. This makes the hold restriction on that security apply only to this account. For more information, see Security Restrictions Settings.

Next, you can make the legacy position count towards an account's allocations in one of two ways:

-

Add to Model. Add the legacy position to the appropriate Security Level model.

-

Substitute. Make the legacy position a substitute for a similar position within the model. For more information, see Security Substitutes.

Buy the legacy positions rather than model Securities

For some accounts, the legacy position is a close proxy to an existing security within your models, and buying more of the legacy position is appropriate. In some cases, a mutual fund in a model becomes soft close and can only be purchased by accounts that already hold the fund.

In cases like these, take one of these steps:

-

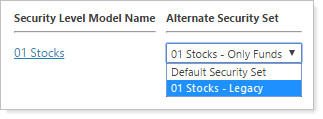

Alternate Security Set. Create an alternate security set on a Security Level model and include the appropriate legacy position. Then, assign that alternate security set to the client's account. For more information, see Create, Edit, and Delete Security Level Models.

-

Soft Close Restriction and Substitute. Add the Soft Close (Purchase if previously held) restriction on the Restrictions page under the Securities menu. Next, make the legacy position the substitute security on a model security with a goal weight of 98% and the highest rank.

-

Soft Close Restriction and Add to Model. Add the Soft Close (Purchase if previously held) restriction on the Restrictions page under the Securities menu. Next, add the legacy position to the appropriate model with a goal weight of 100% and the highest rank.

-

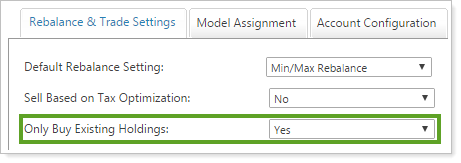

Only Buy Existing Holdings. Select Yes on the Only Buy Existing Holdings list under the Rebalance & Trade Settings tab on the Account Settings page. Then, Advisor Rebalancing will only buy model securities that are currently held in an account.

Set a Security as a Legacy Position

To make a security a legacy position, follow these steps:

-

On the Models menu, click Security Level Models.

-

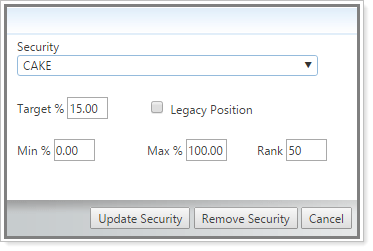

In the Select a Security Level Model list, choose the model where you want to designate the legacy position, and then click Edit next to that security.

-

In the dialog that appears, select the Legacy Position check box and then click Update Security. When you select this option, Advisor Rebalancing will not buy the security for any accounts assigned to the model.

-

Click Save.