Contents

|

|

How Show Capital Gain Distributions Works

| Applies to: | ||

|---|---|---|

| ✔ Dynamic |

✔ Client Portal |

|

This setting allows you to include or exclude capital gain distributions on the report.

Because capital gains are taxed at a different rate than realized gains/losses from the sale of holdings, you may want to display them elsewhere or not display them at all. This setting allows you to determine how these types of distributions are displayed on each report.

In Dynamic Reports

-

To exclude capital gains, clear the Show capital gains distributions check box.

-

To include capital gains distributions, select the Show capital gains distributions check box.

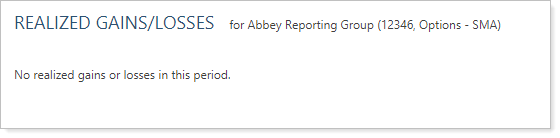

| Show capital gain distributions cleared |

|---|

|

For this report, the only realized gains/losses for the period were capital gain distributions. Clearing this check box means this report returns no results for that period. |

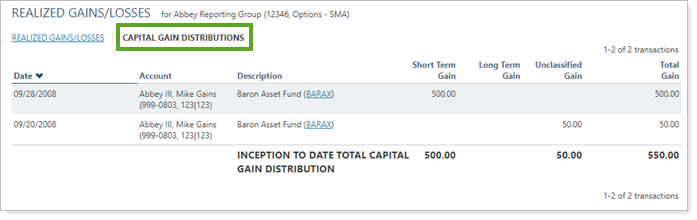

| Show capital gain distributions selected |

|---|

|

Capital gains distributions are included in the report. |

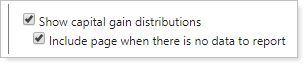

In PDF Reports

Functionality is the same in the PDF report templates as in dynamic reports. However, in the PDF reports, you get the additional Include page when there is no data to report option when you select this setting.

Include page/Text when there is no data to report

Notes

Depending on the page break configuration of the other report sections, this setting is called either Include page when there is no data to report or Include text when there is no data to report. Its behavior remains the same.

This setting allows you to include a blank placeholder space for capital gains distributions, if there were none for the period selected. You might want to do this for consistency. If your PDF report is sorted by account, you may want to include a blank section for any account that doesn't have gains to show that the account wasn't forgotten.

Reports With This Setting

Transaction Reports

|

|