Contents

Create a Billing Definition

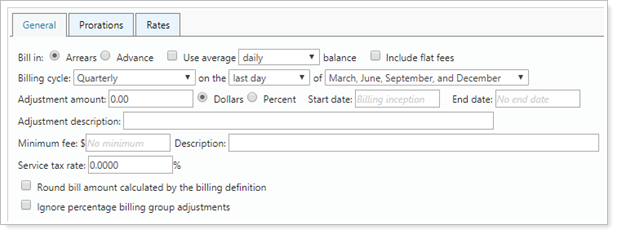

A billing definition defines how you want to calculate fees in Advisor View. In the billing definition, you define items such as the billing method (arrears or in advance), the billing cycle, prorations, rate tiers, adjustments, minimum fees, and service tax amounts.

To create a billing definition:

-

On the Billing menu, click Billing Definitions.

-

In the Billing definition name box, type a name for the billing definition.

-

In the Billing definition description box, type a description for the billing definition.

Note

For billing groups with multiple billing definitions, use the merge field {Billing Definition Description} in the Gross fee calculation title. This merge field dynamically populates invoices with the appropriate billing definition description.

If you don't see {Billing Definition Description} automatically in the Gross fee calculation title, add it with the following steps:

-

Manually add the {Billing Definition Description} merge field to the Gross fee calculation title.

-

Generate a billing history for the account or group.

-

Generate a new PDF billing statement.

-

-

Click the General tab and complete any of the following:

Field... More information... Bill in Choose one of the following options:

-

Arrears. When you select this option, the fee amount is based on the value of the portfolio at the end of the billing cycle.

-

Advance. When you select this option, the fee amount is based on the value of the portfolio at the beginning of the billing cycle.

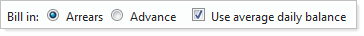

Use average daily/monthly balance Use this setting to designate whether to use average dailyor monthly balance.

To use this setting, select the check box. Then choose from the list billing frequency:

-

Daily: Instead of using the beginning or ending market value of a security to determine the rate schedule to apply, Advisor View will use the average daily value of the billing group.

Notes

-

To take advantage of the average daily balance billing, you must bill in arrears.

-

Prorations are not applicable when using average daily balance billing.

-

-

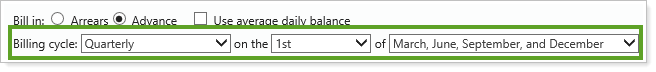

Monthly: The day selected in the billing cycle “on the” setting will be the day each month used to compute the average monthly balance.

Example

If the billing cycle is set to bill Quarterly on the 15th of March, June, September, and December, the average monthly balance for Q4 billing will be the average of the billable values on October 15, November 15, and December 15.

Include flat fees Click this check box to bill your clients at a flat fee. When you set up rates on the Rates tab, you can use a single dollar amount or you can use a tiered asset range approach. Billing cycle Choose the billing cycle for the billing group.

Unlike most portfolio accounting systems that use exact dates that must be changed each time you generate a billing statement, Advisor View billing definitions use the billing cycle and as-of date to determine the billing dates. With this feature, you won't need to update your billing definitions each time you need to generate a billing statement.

Adjustment amount Enter a miscellaneous adjustment amount, such a discount for new clients, for all accounts assigned to the billing definition. You can specify the adjustment as a dollar amount or as a percentage.

To specify a discount or credit, type a dash before the dollar amount or percentage - for example, type -100.00 to give a discount of $100.00.

To specify additional fees, type the fee as a positive value - for example, type 100.00 to add a fee of $100.00.

Adjustment description If you specify an adjustment amount, type a description for the adjustment in the Adjustment description box. The description you enter will print on the billing statement. Start/End date for adjustment If you want to provide an introductory rate to certain clients, you can specify an expiration date for billing adjustments. For example, let's say you want to give new clients a 15 percent discount for three months.

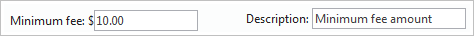

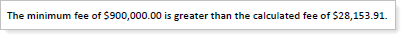

Minimum fee Specify a minimum fee for the billing definition. This value is used if the calculated amount for fees is less than the minimum fee. If you want to include negative fees in your minimum, you can click on the right side of the Minimum fee box, and then click on the "X" button that displays. The box will then display No minimum.

If you specify a minimum fee amount, type a description for the minimum fee amount in the Description box. The description you enter will print on the billing statement.

If you do not add a description for the minimum fee amount, Advisor View will add the following text next to the fee on the billing statement:

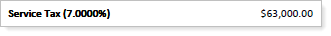

Service tax rate Type the service tax rate for your area.

The service tax rate will appear as a fee on the billing statement.

Round total bill amount Select this check box if you want Advisor View to round the total bill amount.

When selected, Advisor View will automatically round amounts between 1 and 49 cents down to the next dollar and automatically round amounts between 50 and 99 cents up to the next dollar.

At this time, Advisor View will round the amount calculated for the billing definition, but it does not round account or billing group adjustments.

Ignore percentage billing group adjustments This billing definitions setting is intended for firms that apply multiple billing definitions as well as billing group discounts to a billing group. If your firm applies multiple billing definitions to one billing group, select Ignore percentage billing group adjustments at the definition level to ignore any billing group adjustments that are a percentage fee.

Example

Cherry Street Financial bills Georgia Abbey with a billing definition that includes a standard billing group definition and an additional billing definition that gives a percentage credit for accounts holding certain mutual funds. They select Ignore percentage billing group adjustments to apply the adjustment only to the standard billing definition, not to the subsequent definition for a mutual fund discount.

Note

This applies only when the billing group adjustment is a percentage.

-

-

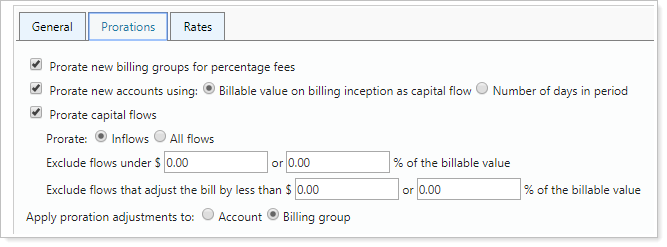

Click the Prorations tab and complete the information below.

| Field... | More information... |

|---|---|

| Prorate new billing groups for percentage fees |

When you select this option, Advisor View will prorate the percentage fees on the bill for the period of time which the first account within the billing group was open and funded. To prorate additional accounts which joined the billing group during the period, but after the inception of the billing group, the billing inception date must be set on the additional accounts you would like to prorate. When using average daily balance, the average daily balance will be used for the days from the inception date of the billing group to the end of the period. The rate tier is then applied to this value and the bill is prorated for the portion of the period the account was open. |

| Prorate new billing groups for flat fees |

When you select this option, Advisor View will prorate the flat fees on the bill for the period of time which the first account within the billing group was open and funded. To prorate additional accounts which joined the billing group during the period, but after the inception of the billing group, the billing inception date must be set on the additional accounts you would like to prorate. When using average daily balance, the average daily balance will be used for the days from the inception date of the billing group to the end of the period. The rate tier is then applied to this value and the bill is prorated for the portion of the period the account was open. |

| Prorate billable value for billing allocation |

When you select this option, Advisor View will prorate the billable value for billing allocation for the period of time which the first account within the billing group was open and funded. To prorate additional accounts which joined the billing group during the period, but after the inception of the billing group, the billing inception date must be set on the additional accounts you would like to prorate. When using average daily balance, the average daily balance will be used for the days from the inception date of the billing group to the end of the period. The rate tier is then applied to this value and the bill is prorated for the portion of the period the account was open. |

| Prorate capital flows |

When you select this option, Advisor View will make prorated adjustments for capital flows in the previous billing cycle. |

| Prorate |

Choose one of the following options for proration of capital flows:

|

| Exclude flows under |

Enter the smallest amount you want to make adjustments for. Any flows less than this amount will be excluded from proration. |

| Exclude flows that adjust the bill by less than |

Enter a minimum adjustment amount for prorations. For example, if you want to exclude any flows that adjust the bill by less than $100, simply type $100. |

| Apply capital flow adjustments to | Advisor View gives you the option to apply capital flow adjustments at the account level instead of the billing group level. This will result in the account performance truly reflecting the account level capital flows. |

-

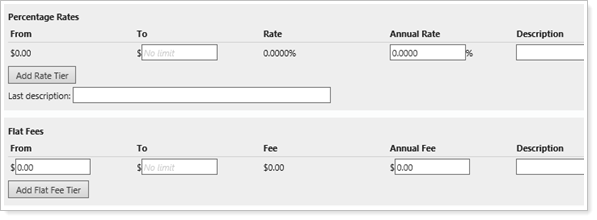

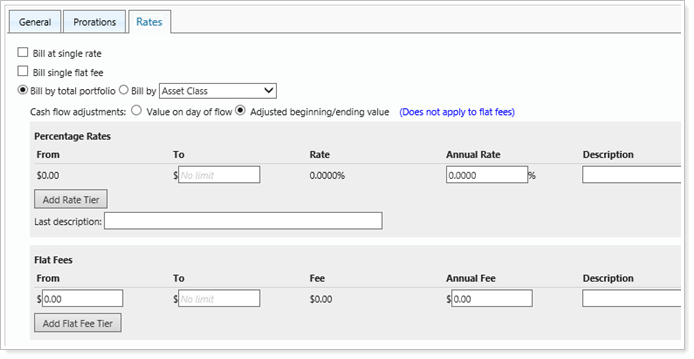

Click the Rates tab and complete the information below.

| Field... | More information... |

|---|---|

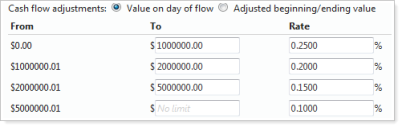

| Bill at single rate |

When you select this check box, Advisor View assigns one billing rate to the entire account. ExampleLet's say you set up the following rate tiers:

With single rate billing, a portfolio with the value of $1.5 million would be billed at a rate of .20 percent and a portfolio with the value of $5.5 million would be billed at a rate of .10 percent. If you do not use single rate billing, a portfolio with the value of 1.5 million would be billed like this: the first $1 million would be billed at a rate of .25 percent, and the remaining $500 thousand would be billed at a rate of .20 percent. |

| Bill single flat fee | When you select this check box, Advisor View determines the flat fee that applies, and applies it to the entire account. |

| Bill by |

Select one of the following options:

|

| Cash flow adjustments |

Choose the cash flow adjustment method you want to use. Your choices are:

|

| Add rate tier |

With tiered pricing, you can set up different pricing tiers based on security categories (asset class, security, sector and subsector) or you can bill based on the entire value of the portfolio. Your rate tiers can be percentage rates or flat fees (if you selected the Include flat fees check box on the General tab).

Percentage rate tiers must be sequential, without gaps (e.g., $0.00-$100, $100.01-$200). Flat fee rate tiers must be sequential and can't overlap, but gaps are allowed and you don't have to start at zero (e.g., $10-$100, $200-$300). For more information on setting up rate tiers, visit one of the following pages: |

| Additional check boxes available if you bill by a category: | |

| Allocate based on category values |

Select this check box if you want to bill by the values of each category (asset class, sector, subsector, and security). When you select this check box, Advisor View allocates the bill amount based upon the values in each category for the billing group. |

| Use SMA categories |

When billing by category for asset class, sector, or subsector, you can use the SMA categories instead of the underlying securities to determine the rate calculation. For example, let's say you have an SMA that is assigned a fixed income asset class. When you enable this option, Advisor View will treat the entire portfolio as a fixed income security. |

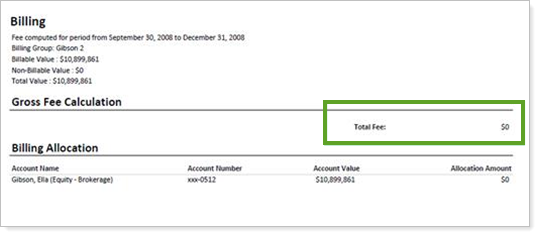

| Suppress bill when not held: |

Suppresses billing statements when the fund or category was not held during the billing cycle. For example, you might have had a fund that was bought and sold multiple times in specified accounts—but that is not held as of the billing date. In this case, a billing statement would be generated, but you could choose not to display a statement for that billing definition. When you generate a PDF and have suppressed billing for funds that were not held, you will be notified that a statement was dropped. If you have not suppressed billing for these funds, the billing statement will show $0 as the total fee.

|

-

Click Save.

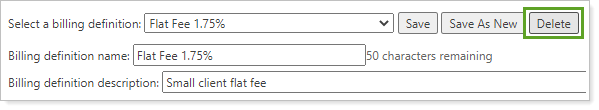

Edit a Billing Definition

To edit a billing definition:

-

On the Billing menu, click Billing Definitions.

-

In Select a billing definition, choose the billing definition you want to edit.

-

Make the changes to the settings as desired. See Create a Billing Definition for settings details.

-

Click Save.

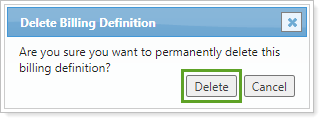

Delete a Billing Definition

You can only delete a billing definition that is not in use. For information about how to identify what billing definitions are used, see How Can I See Which Billing Groups Are Using A Specific Billing Definition?

To delete a billing definition:

-

On the Billing menu, click Billing Definitions.

-

In Select a billing definition, choose the billing definition you want to delete.

-

Click Delete.

-

In the Delete Billing Definition dialog, click Delete.