Contents

Reporting

Include Leads on the all Activities Report

Many of you have asked for an update to the All Activities report so you can get a full picture of the activities for both prospective and current clients. We're excited to say that you can now view activities for leads on the All Activities report. When you run the report, you can choose whether to track the creation and completion of activities for either clients you're hoping to win or for existing clients (families or accounts).

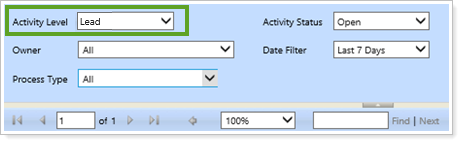

You can select Lead from the Activity Level list in several locations:

-

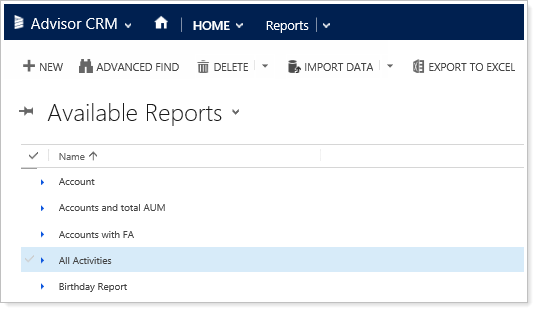

When you open the All Activities report, accessed by clicking Reports in the menu.

-

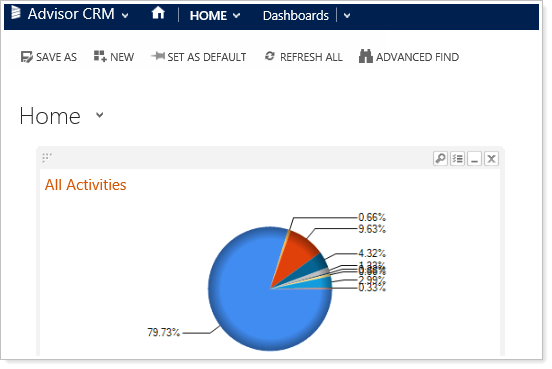

When you change settings for the All Activities report on your dashboard, accessed by clicking Dashboards in the menu. You will only see the report if you've added it to the dashboard.

-

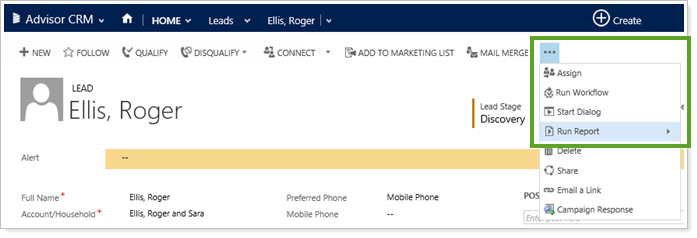

When you run a report from a specific account or lead you're viewing—the report will then be specific to that account or lead.

Increased Flexibility for managing RMD INformation

Many of you have requested more flexibility around RMD management, so with this release we've provided a way to override the existing RMD eligibility status, allowing you to increase the accuracy for RMD classification.

Here are some of the changes you'll see for RMD Management:

-

When you open a financial account for a client, a new section for RMD Management allows you to see RMD Eligibility and change it, if needed.

-

New columns have been added to the RMD Planning report.

-

The existing “Financial Account – RMD Clients” view has been updated to match the report criteria, which will allow you to take quick action for those who still have an RMD outstanding.

These changes will make it easier for you to track RMD requirements, help clients comply with RMD law, and reduce clients' risk of accidental penalties.

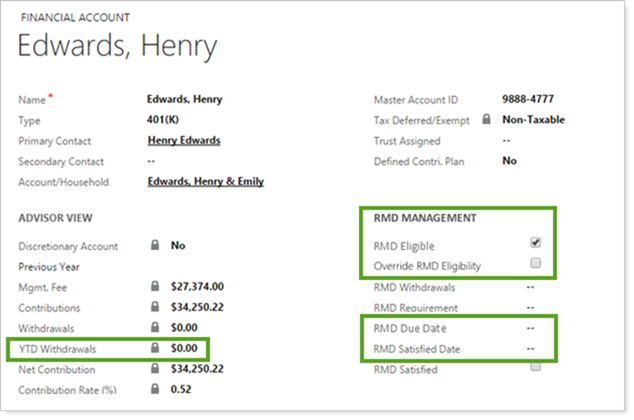

> RMD Management section in financial accounts

The new fields for financial accounts allow you to set RMD dates and change the RMD eligibility setting (indicated with the RMD Eligible check box). We have also moved the YTD Withdrawals field under the Advisor View section, and that functionality remains unchanged.

Advisor CRM runs a job twice a day to automatically identify financial accounts which are eligible for RMD, using specific criteria. If you find that an account is inaccurately marked as eligible, you can enable overrides by clicking the Override RMD Eligibility check box, and then you can clear the RMD Eligible check box, or select it if it was not selected and should be.

The RMD Eligible check box not only indicates whether the Financial Accounts listed on the report are eligible for RMD, but it also determines whether the account is included in the RMD Planning report. If the check box is not selected, the account will not be included in the report.

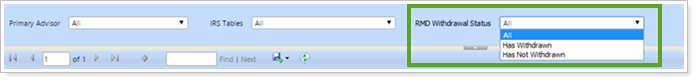

> New columns for the RMD Planning report

A new filter for the RMD Planning report allows you to easily see who has or has not withdrawn RMD, or you can view all RMD eligible accounts. The RMD Eligible check box setting for each financial account influences which accounts will be displayed.

We also added three new columns to the report:

-

RMD Due Date. Indicates the date the RMD must be withdrawn by for the Financial Accounts listed on the report.

-

RMD Requirement. Indicates the RMD amount for the Financial Accounts listed on the report.

-

RMD Satisfied Date. Indicates when the RMD was actually satisfied for the Financial Accounts listed on the report.

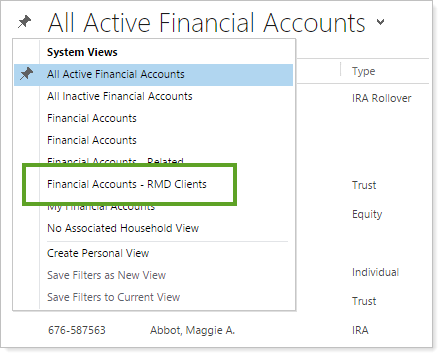

> New Views Match rmd Report criteria

You can select a view specific to RMD reports for financial accounts. This view is called Financial Accounts–RMD Clients, and it should mirror the Financial Accounts listed on the full report.

Workflows

Track RMD Tasks with a new Workflow

The new RMD Satisfied workflow creates a closed task when you select the RMD Satisfied check box for Financial Accounts. This automated process allows you to maintain an accurate historical record of RMD withdrawals so you'll have an audit trail of when the RMD was satisfied for a particular Financial Account.

Usability

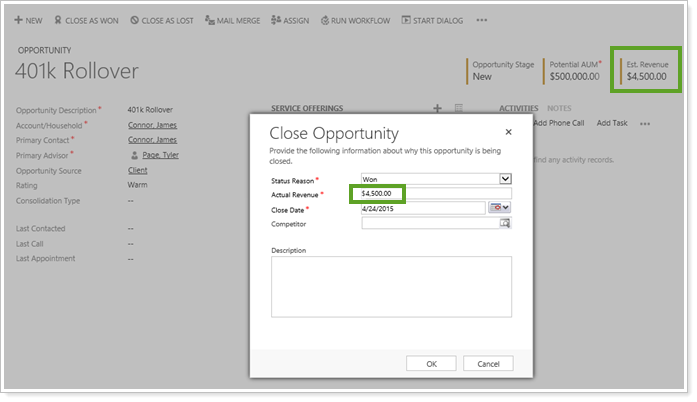

See Estimated revenue When you close Opportunities

We listened to your requests to change the value shown when you close opportunities. Now when you close opportunities as won or lost, the Actual Revenue box shows Est. Revenue instead of showing Potential AUM (Won), or $0.00 (Lost).

Account Maintenance

Expanded Options Available for Custom Fields

Currently, you can request custom fields for Accounts, Contacts, Leads, Financial Accounts, Rebalancing Groups, and Reporting Groups.

We're pleased to announce that now custom fields can also be added for:

-

Assets

-

Liabilities

-

Service Offerings

-

Opportunities

-

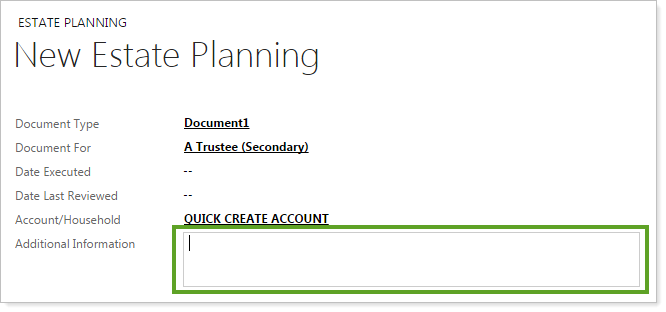

Estate Planning

-

Tax Planning

-

Insurance Planning

We've also allowed longer names for custom fields, and have added space for a second line in the multi-line text box.

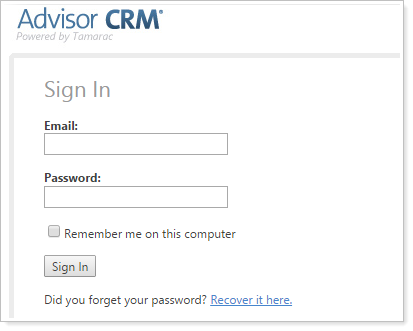

Updated and Improved Login PAGE

We updated the login page to match the other products on our Advisor Xi® platform, and we're excited to offer both a Remember Me option and a password recovery link on this page.

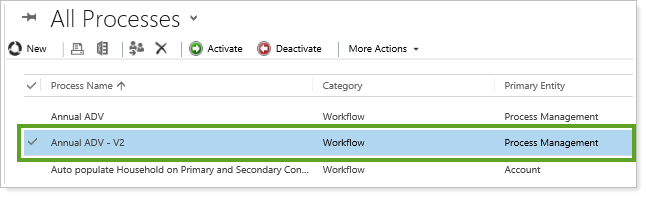

Old Versions of WOrkflows Now Retired

When we added updated versions to workflow processes and templates (V2), we retained the previous versions (V1) as an extra backup option during the transition. Now that everyone has had a chance to successfully move to V2, we're removing any old versions to streamline the list and avoid any confusion about which templates and processes to use. All workflows will still be available, and only old versions that are not currently activated will be removed.

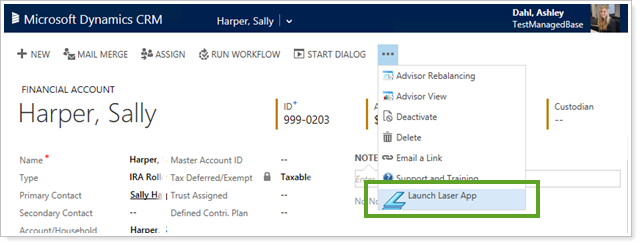

LaserApp Anywhere Integration

We're extending our current desktop integration with LaserApp to include their web version—LaserApp Anywhere. Administrators at your firm can now choose which version of LaserApp each user connects to, increasing flexibility across your firm.

The LaserApp integration options are none, desktop, or web (Anywhere)—administrators can choose an option when they go to the Administration page, click Users, and then edit a user.

If the integration is set to none, the user will not see the Launch LaserApp icon. Otherwise, they will continue to see the icon, and it will take them to the version they've been set up to use.

Learn More - Watch the Release Video